MVPD/ISP Deals Meaningful, Not Dominant Contributor to Netflix

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

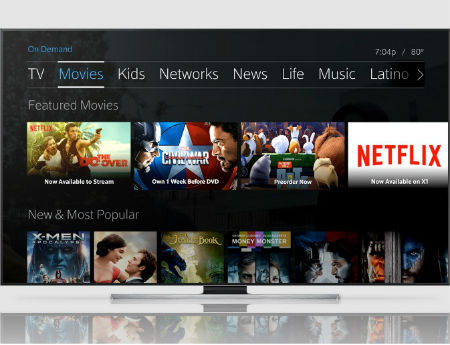

Partnerships with pay TV operators, ISPs and other service providers are valuable contributors to Netflix’s subscriber growth and could play an even larger role as the OTT provider looks more deeply into agreements that bundle in the Netflix service.

Netflix doesn’t break out what percentage of new customers come through its various partnerships with ISPs and MVPDs, but they are a “meaningful contributor, but not a dominant contributor in terms of being a major channel for us in terms of acquisition,” David Wells, Netflix’s CFO, said Monday in the company’s Q4 2017 earnings interview with Sanford C. Bernstein analyst Todd Juenger.

Netflix is a “multi-impression sale,” he added. “If somebody joins us through a partner, it isn’t necessarily because that partner did a specific promotion.”

Spencer Wang, Netflix’s VP of investor relations/corporate development, stressed that, given the regional nature of MVPDs and ISPs, any single partnership isn’t particularly material to Netflix’s global net additions.

That said, the importance of partnerships is growing as Netflix gets “embedded” into more ISPs on more CE devices, Wells said.

Greg Peters, Netflix’s chief product officer, noted that set-top box integrations does give Netflix exposure to consumers who are consuming more linear TV and could be later adopters to the OTT service. Wells also acknowledged that there’s a “churn benefit” to those partnerships.

Peters noted that Netflix is increasingly taking a look at how the service could be bundled with operator offerings.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

While that hasn’t happened to a great degree with MSO partners, T-Mobile is already bundling Netflix as part of its “Netflix on Us” promo. Hulu, meanwhile, has a similar deal with Sprint.

RELATED: T-Mobile Gives Away Netflix Subscriptions

Netflix handily beat its sub forecasts in Q4, contributing in large part to consumer interest in Netflix’s content, but Wells admitted that the company was a “little conservative” heading into that quarter following recent price increases.

RELATED: Netflix Adds 8.33 Million Subs in Q4

“The real driver is to make the big titles bigger,” Netflix CEO Reed Hastings said. “That’s the dominant accelerator.”

Netflix also defended its plan to spend between $7.5 billion to $8 billion on content on a P&L basis in 2018, confident that it’s getting a healthy return on that investment.

“At some point if we see we’re not growing viewing hours, we’re not growing subs, not growing enjoyment, then you’ve hit a point of diminishing returns,” Ted Sarandos, Netflix’s chief content officer, said. “We just haven’t seen that yet.”

Hastings added that he expects that spend to go higher in 2019 and 2020.

The Netflix CEO also weighed in on the proposed Disney-Fox deal.

RELATED: Disney Pulls Fox Trigger

“I was surprised as anyone else that fox was willing to sell,” Hastings said. “And to have all of those cable networks together in one bundle gives them tremendous pricing power against MVPDs…So I could see the attractiveness of it.”

Hastings also expects Disney’s plans to launch direct-to-consumer services in 2018 to be “very successful,” but downplayed the impact it will have on Netflix.

“We don’t see it as a threat to us any more than Hulu has been,” he said, adding later that the whirlwind of M&A activity involving major U.S. media companies “are pretty peripheral to us.”

And don’t expect Netflix to change or alter its business model to include advertising.

Being ad-free “is a core differentiator,” Hastings said. “We’re having great success on the commercial-free path; that’s what our brand is about.”