NBCU Satisfied With Gains in Weak Upfront

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Linda Yaccarino, NBCUniversal’s dynamic president of ad sales, faced a tough assignment this upfront in raising both the company’s dollar volume and ad rates, particularly at NBC, the top-rated broadcast network last season. A weaker than expected market didn’t help.

“Everyone would have benefited if the volume in the market was better,” Yaccarino said, recapping what she called a very interesting upfront. “We wished the volume would have been greater, but we’re satisfied with our portfolio performance across the board.”

Is Yaccarino’s boss, NBCU CEO Steve Burke, happy with the performance? “I think you should listen to [parent company Comcast’s] earnings call next week,” Yaccarino said. “You’ll probably hear that he’s a happy man.”

With NBCU commanding a broad array of assets ranging from broadcast to cable to digital, entertainment to news and both English and Hispanic, Yaccarino has a sweeping view of the media landscape. “Broadcast was softer than anyone expected,” she said. Original projections were for upfront spending that was flat to down compared to last year. “Now it looks like spending might have been down as much as 7% to 10%.” According to sources, Fox’s upfront sales were down as much as 15%.

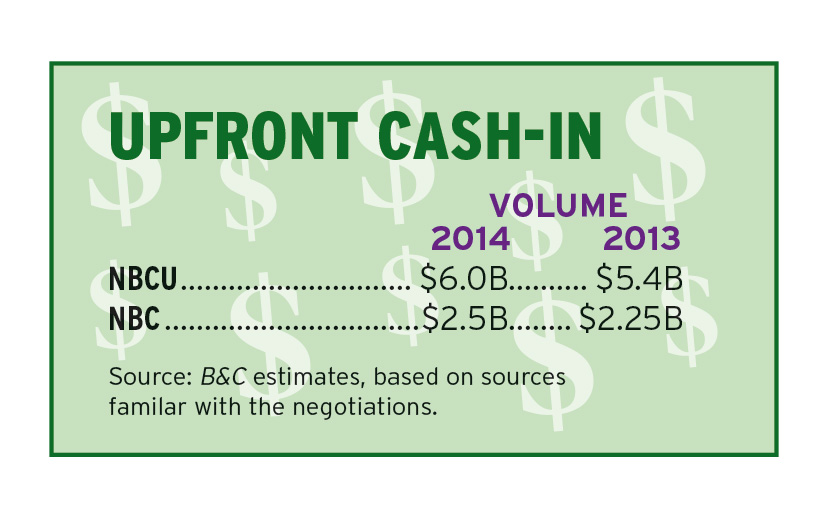

“For NBC, thankfully, NBC saw quite the opposite of that,” Yaccarino said. NBC’s volume was up 11% to 12%, and 15% if you don’t count sports, where Sunday Night Football is the highest-rated show.

That made negotiations tricky. “With budgets being down so much at other places, buyers had different price expectations,” Yaccarino said. After a decade in the ratings basement, NBC’s ad prices on a cost-per-thousand-viewers (CPM) basis had fallen as much as 20% behind its rivals, making it a bargain for buyers.

One of NBC’s goals was to close that gap, and NBC’s rate of change in pricing was almost double the market average, Yaccarino said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

For Yaccarino, the weakness of the cable entertainment market was even more surprising than broadcast’s dip. Because it makes its upfront deals on a portfolio basis— closing broadcast, cable and digital in one package—NBCU was done with its cable upfront earlier than other big cable programmers. “With networks like USA and Bravo and E!, the demand continues to be unique, so we were very satisfied with where we landed,” she said.

Disappearing Act

Sales execs are trying to figure out where the money that was expected to be in the upfront went. Yaccarino sees two possibilities. One is digital video, which could account for as much as $350 million of the shortfall. The other is that marketers prefer to hold on to their ad dollars rather than commit them upfront.

“We’re seeing much more year-round conversations,” Yaccarino said. “People keep that money to buy programs or multiplatform partnerships at any time of the year, not just during the upfront. It’s fueled by quite a bit of choice that’s out there. But they just want more flexibility so they can run their own businesses as they see fit and take advantage of opportunities when they come up.” Those tactics could fuel the scatter market, she notes.

A lot of the pre-upfront talk from the broadcasters involved a shift to C7 commercial ratings that allow them to sell more delayed viewing impressions. One major agency, GroupM, made agreements with all the networks to use C7, and Yaccarino said GroupM wasn’t the only one doing so. But in total, not that much of NBC’s business was done on C7 this year.

Beyond C7, Yaccarino said NBCU seeks more sophisticated measurement. The core audience of business news network CNBC is virtually unmeasured, she noted, as is consumption of many NBCU cross-platform initiatives.

“More accurately measured GRPs are good for everyone, and more accurately measured viewing is better for everyone. But the reality is with multiple-device viewing and consumption that isn’t measured, it’s challenging for networks in a world of fragmentation; the individual networks are struggling for scale in many cases,” she said.

Earlier this year, NBCU came out with a new data-based product, NBCU Plus Powered by Comcast, which promised improved targeting and the ability to better measure return on investment. Yaccarino said it was popular in the upfront. “In every case in which our partners signed on for NBCU Plus, they expanded their relationship with us,” she said.

Ultimately, what was behind NBCU’s upfront performance was owner Comcast’s investment in programming, which is beginning to pay off. “Our clients believe in those investments. After a decade where everyone hoped or wished we’d get better, this year they rewarded us for a great performance,” she said. “It was really a vote of confidence in the future of NBCUniversal.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.