NBCU Taps iSpot as First Cross-Platform TV Measurement Alternative to Nielsen

Publicis Media set for currency Q1 currency test including Super Bowl, Olympics

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

NBCUniversal, conducting a high-profile process to find measurement approaches that better fit the modern media world, tapped iSpot.TV as the first company in the stable it will use for quantifying cross-media video consumption in advertising sales transactions.

Media buyer Publicis Media and several of its clients will run the initial test of iSpot.tv as currency starting in the first quarter across all of NBCU’s programming, including the Super Bowl and Winter Olympics. The object is to properly measure and value TV advertising on NBCU in time for the upfronts.

NBCU plans to certify more measurement companies in the near future, giving itself and its clients a group to choose from.

The move comes at a time when Nielsen, which has dominated TV measurement for decades, is under unprecedented pressure.

Last year, network complaints that Nielsen undercounted viewing during the pandemic was confirmed by the Media Rating Council, which also suspended its accreditation of Nielsen’s TV ratings services.

Nielsen also disclosed that it hadn’t been including some out-of-home viewing into its viewership totals and its plan to include broadband only homes in the ratings has been criticized.

The issues with Nielsen have created a fertile environment for Nielsen’s potential rivals and most media companies have stepped up their efforts to identify, test and use alternative currencies going into the upfront.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

ViacomCBS has made deals to use Comscore and VideoAmp as currency has has begun to make national ad sales deals using VideoAmp data. Last week, WarnerMedia announced it had picked Comscore, iSpot and VideoAmp as potential alternatives to Nielsen and will be testing their data in order to use them for upfront deals.

iSpot is among the first to use automatic content recognition (ACR) data from smart TVs to track the impressions accumulated by TV commercials. NBCU was among the first media companies to subscribe to iSpot’s data in 2014. NBCU has also been working with iSpot on measuring business outcomes and the effectiveness of advertising.

“NBCU is leaning into giving advertisers what they want: fast, accurate and granular cross-platform measurement that proves the value of investments,” said Sean Muller, founder and CEO of iSpot.tv. “We applaud the work NBCU kicked off last year to accelerate the TV industry toward a more audience-centric, cross-screen and outcome-oriented framework that helps brands invest with confidence.”

iSpot.tv will be measuring audiences for both programs and commercials. It will provide brands advertising with NBCU with real-time airing data for linear, streaming and time-shifted viewing. Including verified ad impressions, reach and frequency, linear and streaming overlap and incrementality. These days commercials have to be measured separately from programming because with increased targeting and addressable ad technology, the ads one consumer sees in a show could be different from what their neighbor sees.

Select NBCU advertisers will have access to impact measurements including granular attention and interruption rates, business-outcome reporting and creative performance that includes pre-testing and brand-lift analysis from iSpot and NBCU.

Also, iSpot.tv’s Ace Metrix product lets advertisers pre-test ad creative to gauge the brand impact, favorability, emotional response and effectiveness of messaging, and conduct in-flight analyses.

“Measurement must reflect the all screen, one video world consumers have created,” said John Muszynski, chairman, Publicis Media Exchange US. “Through this test-and-learn across NBCUniversal’s One Platform, PMX will be able to provide its portfolio of brands more accurate, holistic approach to measurement that prioritizes performance and impact. The results of this partnership will serve as the blueprint for the marketplace to transact using improved measurement during the 2022-2023 Upfront Cycle.”

Nielsen has been working to update its measurement system and is working to roll out Nielsen One, which will combine its traditional panel-based measurement with more big data from set top boxes and smart TVs in order to count all program and ad viewing on a consistent and comparable basis.

Nielsen is participating in NBCU’s process and NBCU said it is not looking for a substitute for Nielsen.

“This is not a shift away from one panel-based system to another, but a definitive step toward embracing the metrics brands already use to evaluate media companies,” said former Nielsen executive Kelly Abcarian, now Measurement & Impact executive VP at NBCU.

“We have an obligation to deliver consumers a great experience, and an obligation to our customers and shareholders to utilize measurement systems that adequately capture the reach, attention, and outcomes we deliver,” Abcarian said. “Our learnings from this partnership will help transform our measurement solutions as we head into the next Upfront season, and bring advertisers more data that accurately reflects our audiences, their consumption habits and campaign impact.”

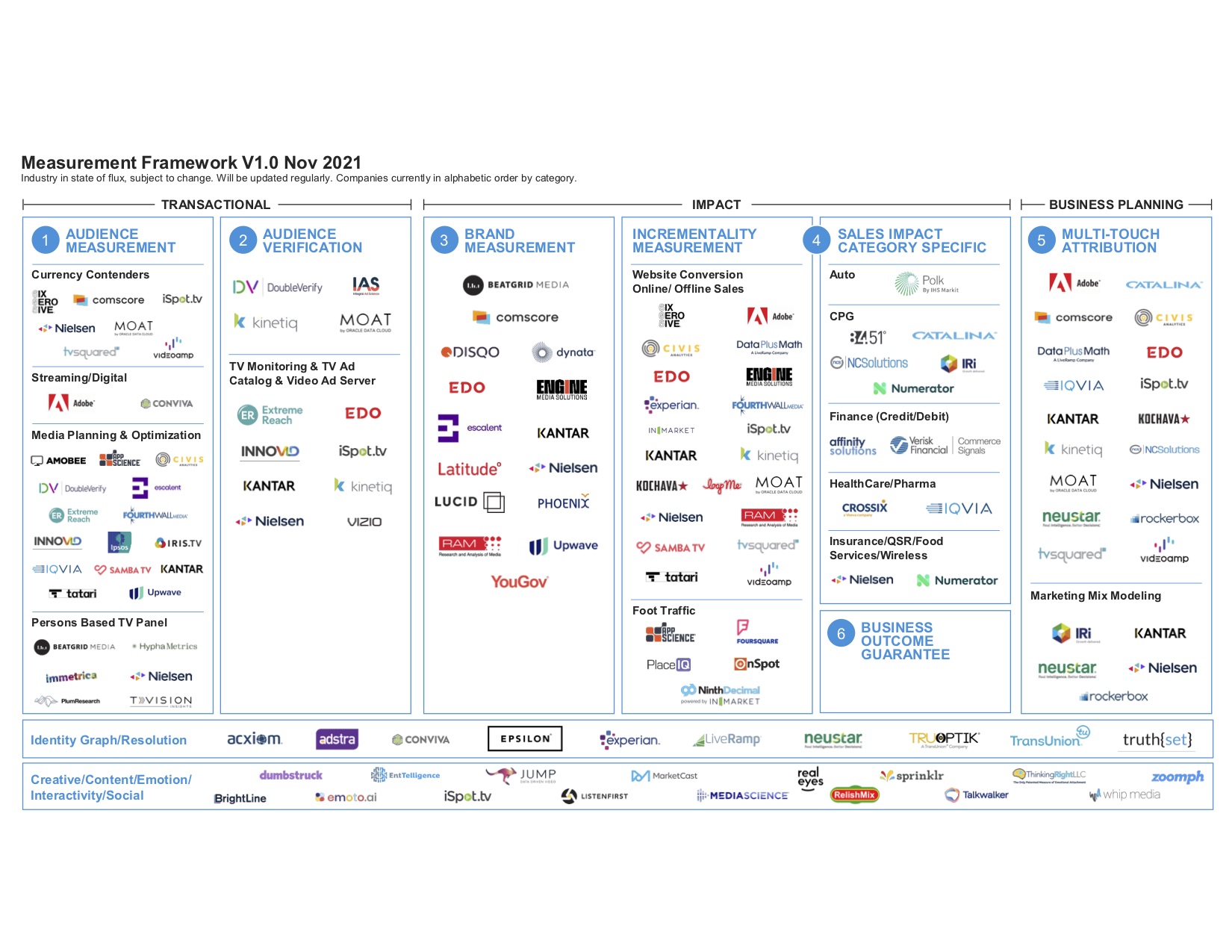

NBCU launched its measurement bakeoff last Summer by sending requests for proposals to 54 measurement and data companies. At this point NBCU has fielded proposals for more than 100 interested vendors. Those applying ranged from traditional players like Nielsen, Comscore and Kantar, streaming oriented outfits like Conviva, Truthset, VideoAmp and iSpot, to newcomers IBM with Watson AI, Thinking Right, Reelgood, EntTelligence and Relish Mix. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.