Netflix CFO Expects Company’s Ad Business To Be Larger Than Hulu’s

Ads could be 10% of revenue, or $3 billion, over time, Spencer Neumann says

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Netflix has only been in the advertising business for a couple of months, but it is already predicting it's ad revenue will be bigger than Hulu's.

The Netflix Basic with Ads business got off to a slow start, with the company having to return money to advertisers because it didn't have as many eyeballs as promised.

But speaking on the company's fourth-quarter earnings call Thursday, Netflix execs said they saw positive signs and expected big things.

Also: Netflix Has Huge Q4, Exceeds Guidance on Revenue and Subscribers

Egged on by Executive Chairman Reed Hastings, Netflix CFO Spencer Neumann estimated that about half of Hulu’s subscribers are on an ad-supported tier and that advertising is a multi-billion dollar business for Hulu. He noted Hulu operates only in the U.S., while Netflix is selling ads in multiple markets.

“We would expect to be as large or larger over time, certainly in just or U.S. market and more from there,” Neumann said.

“It’s a multi-year path,” he added. “We’re not going to be larger than Hulu in year one, but hopefully over the next several years we can be at least as large. We wouldn’t be getting into this business . . . if it couldn’t be a meaningful portion of our business.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Meaningful seems to mean at least 10% of revenue, he said. With Netflix’s revenues at about $30 billion, that would mean $3 billion in ad sales down the road.

Newly named Netflix co-CEO Greg Peters, who spearheaded the ad launch, pointed to some early positive signs.

Peters said that the company’s ad tech is working and the product experience is good.

He added that engagement with ad-plan users is comparable to similar users of non-ad plans. “It means we’re delivering a solid experience and it’s better than we modeled.”

He added that the take rate and growth of the ad plan is “solid,” and that people signing up for the lower-priced product are mostly not current Netflix subscribers.

“We aren’t seeing, as expected, much switching from high ARM (average revenue per member) subscription plans like premium into our ad plans. So the unit economics remain very good.”

Netflix did not provide numbers for its ad business so far, but a report by research company Ampere Analysis said that Netflix’s ad tier launch helped give the company its highest domestic sign-up rate since April 2020.

In the three days after the launch of the ad-sales tier, Netflix’s daily sign-up volume jumped 58%, compared to the three days before the launch, Ampere said.

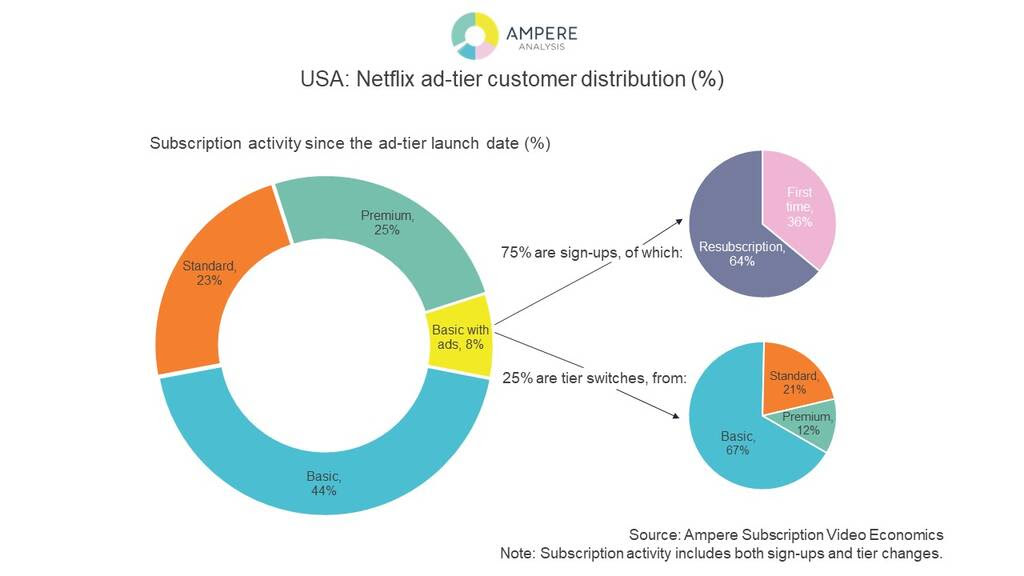

Since the launch, 8% of those signing up for Netflix or changing their plan have taken the ad tier. Ampere said that 75% of those signing up for the ad tier are either former Netflix members resubscribing or first-time users. The other 25% are switching tiers, with 67% coming from the lowest price tier without ads. Just 21% come from Netflix’s “standard” tier and 12% from a “premium” tier.

“Netflix’s ‘Basic with Ads’ tier, which is $3 per month cheaper than the Basic tier, has succeeded at drawing back more price-sensitive Netflix subscribers who had previously churned,” said Mayssa Jamil, analyst at Ampere Analysis.

“In addition to this, with the strengthening of competitor services, the low $6.99 price point makes it more affordable to subscribe to multiple services at once, and has therefore also appealed to heavy stackers. Finally, some Basic tier users (who are more prone to churning as economic uncertainty and competition increases) have been downgrading to the ad-tier, which will aid customer retention in the long-term,” Jamil said.

Netflix’s Peters said there were technical improvements being made to the Netflix ad product. Some involve ad delivery validation and measurement.

Also targeting needs to be better, which will help consumers by giving them more relevant advertising and advertisers by delivering more value.

“There’s also some nuts and bolts stuff that we are learning and improving. Things like we have to do a better job with Microsoft at the ad sales and operations process,” he said. “There’s so much that we need to do–both companies–to better serve an increasing number of advertisers and meet that demand.”

Netflix announced that it will be making a presentation to media buyers during the traditional broadcast network upfront week, taking the Wednesday evening time slot vacated by CBS parent Paramount Global.

Asked what that means by Bank of America analyst Jessica Reif Ehrlich, Peters said “it does signal, we have big aspirations here and we think there's a big potential opportunity.”

He noted that Netflix’s ad business was essentially starting from zero.

“We're also starting from a history as a non-ads platform/ We had a lot of folks basically join Netflix as non ad subscribers.. . I think that we will be working through that over a period of time. But again our goal and aspiration is that this is a very meaningful and significant source of revenue and profit for us over many years to come,” Peters said.

How about getting into the fast-growing free ad-supported streaming television channels business, the Netflix execs were asked.

"We're open to all these different models that are out there right now, but we've got a lot on our plate," said co-CEO Ted Sarandos. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.