Netflix Shares Crater Around 25% as Service Loses 200,000 Subscribers in Q1

Expecting to lose another 2 million users in Q2, Netflix said it will crack down on account sharers, up its content game ... and (shudder) ponder ad-supported streaming

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In an ominous sign for the broader video business, Netflix watched its stock crater more than 25% in after-hours trading Tuesday afternoon, following the streaming service's disclosure that it lost subscribers in the first quarter.

Equity analysts' consensus forecasts, and Netflix's own guidance, had suggested narrow global growth of around 2.5 million paid users for the quarter.

Netflix actually lost around 200,000 subscribers in Q1, finishing March with 221.64 million subscribers globally. And if that weren't enough for Wall Street to swallow, Netflix is forecasting the loss of another 2 million subscribers in Q2.

You have to get into the Way Back Machine and venture back to 2011 -- all the way to Netflix's "Qwikster" debacle -- to find the last quarter in which the service lost streaming subscribers.

Revenue also came in underweight, expanding just 9.8% year over year to $7.868 billion. Netflix revenue grew at a 24.2% clip in the first quarter of 2021.

Netflix predicts that revenue growth will fall to 9.7% in the second quarter.

"Our revenue growth has slowed considerably as our results and forecast below show," Netflix said in its quarterly letter to shareholders.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

"Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration -- when including the large number of households sharing accounts -- combined with competition, is creating revenue growth headwinds. The big COVID boost to streaming obscured the picture until recently," the company added.

During his quarterly interview for shareholders, Netflix Co-CEO Reed Hastings said the company would break with long-held subscription-only dogma and develop an ad-supported tier over the next few years.

For now, plenty of Twitter pundits blamed Netflix's sudden growth issues on content.

However, its highly disappointing quarterly report came despite high levels of consumption for shows including producer Shonda Rhimes limited series Inventing Anna, as well as the second season of her hit romantic period drama Bridgerton, which debuted on March 25. There was also Ryan Reynolds' hit comedy-action movie The Adam Project, which also debuted in March.

Notably, in the U.S. and Canada, where the biggest chunk of Netflix's subscriber base resides, the company in January instituted its first price increase since October 2020. It ended up losing around 640,000 customers in the U.S. and Canada from January through March.

Beyond the inflationary pressures impacting all of the global economy, there was also Netflix's decision in March to end service in Russia following that country's unprovoked invasion of Ukraine. Netflix said it had 1 million subscribers in the region.

For its part, Netflix management, which had seen its Nasdaq share price halved going into Tuesday from an all-time high of around $690 a share back in October, attributed their growth crisis to three factors:

> Global broadband issues it can't control: "The uptake of connected TVs, the adoption of on-demand entertainment, and data costs" are factors that affect Netflix's ability to get customers signed up all over the world, the company said. Global supply chain issues have hurt sectors like smart TV, which need to proliferate into homes in order for Netflix to keep growing.

> Account sharing: Netflix said that it has 100 million accounts being shared globally and 30 million in the U.S. and Canada region. "Account sharing as a percentage of our paying membership hasn’t changed much over the years, but, coupled with the first factor, means it’s harder to grow membership in many markets - an issue that was obscured by our COVID growth," Netflix said.

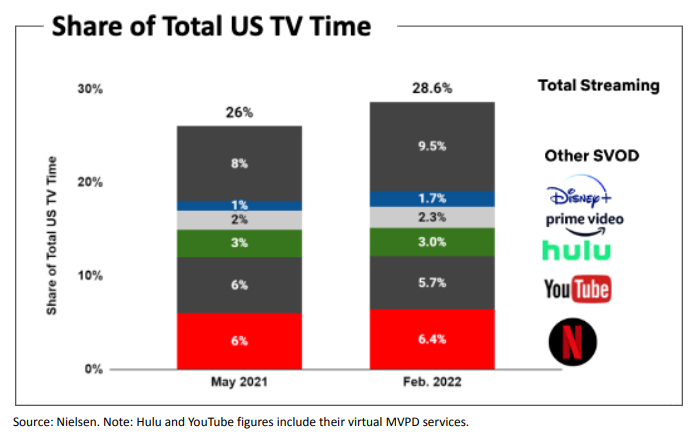

> Competition: This factor may be the most influential of them all. As Re/code's Peter Kafka put it, "Reed Hastings used to have streaming all to himself. That's over now." It turns out that having the traditional media conglomerates realize their "Albanian Army" mistake and correct it by launching Disney Plus, Peacock, HBO Max, Discovery Plus and Paramount Plus, all within a 16-month window, may be taking a toll on Netflix growth. "Over the last three years, as traditional entertainment companies realized streaming is the future, many new streaming services have also launched," Netflix noted.

To get back on the growth track, Netflix said it will continue to "double down" on "improvements in story development and creative excellence," an effort the company said that is already evident in its Q1 hits.

Notably, Netflix CFO Spencer Neumann said Netflix might actually reduce spending on programming in some regions.

“We’re pulling back on some of our spend growth across both content and non-content spend,” Neumann said during the pre-recorded interview. “We’re trying to be smart about it and prudent in terms of pulling back on some of that spend growth to reflect the realities of the revenue growth of the business.”

Meanwhile, Netflix will also expand on a test it conducted in Latin America in which it charged a fee to those sharing their accounts with folks not living with them.

"While we won’t be able to monetize all of it right now, we believe it’s a large short- to mid-term opportunity," Netflix said.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!