The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Time spent streaming movies and TV shows on Netflix in 2023 declined by more than 7 billion hours vs. 2022, based on data provided by Netflix’s own weekly "Global Top 10" ranker.

That’s an almost 17% year-over-year decrease in audience engagement -- a far more significant chasm than what Next TV reported in June, when we crunched similar Netflix self-reported data and found a year-over-year viewing deficit of about 330 million hours, or 4%.

Around the time of our June report, Netflix tweaked its metrics, ranking shows based not on total engagement but on number of "views." This skewed direct YoY comparisons, but the shows that wind up at the top of Netflix's rankings are still those that command the most viewing hours.

And tracking the performance of Netflix's most watched shows every week over the past two years, it’s been undeniable: Netflix simply isn’t churning out the hits like it used to.

The most watched program on Netflix in 2023, Shawn Ryan spy thriller The Night Agent, saw a peak weekly peak engagement tally of 216.4 million hours streamed.

The 200-million-hours-streamed threshold was surpassed three times by Netflix original series in 2022. In fact, in December 2022, freshman series Wednesday drew 411.3 million hours in a single week. But no other Netflix film or series besides The Night Agent even approached the 200 million mark last year.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Netflix wouldn't comment to Next TV on this story. But an individual familiar with company's metrics said that, because the streamer now considers views as the primary qualifier -- rather than watch-time -- the datasets are incomparable.

And while it is true that the new methodology could result in the faulty omission -- or inclusion -- of shows that could skew the data, according to Netflix, over 60% of titles released by the streamer made one of its four weekly top 10 rankers, demonstrating that comparing year-over-year iterations of these lists provides some indicator of how Netflix's overall viewership performance is trending.

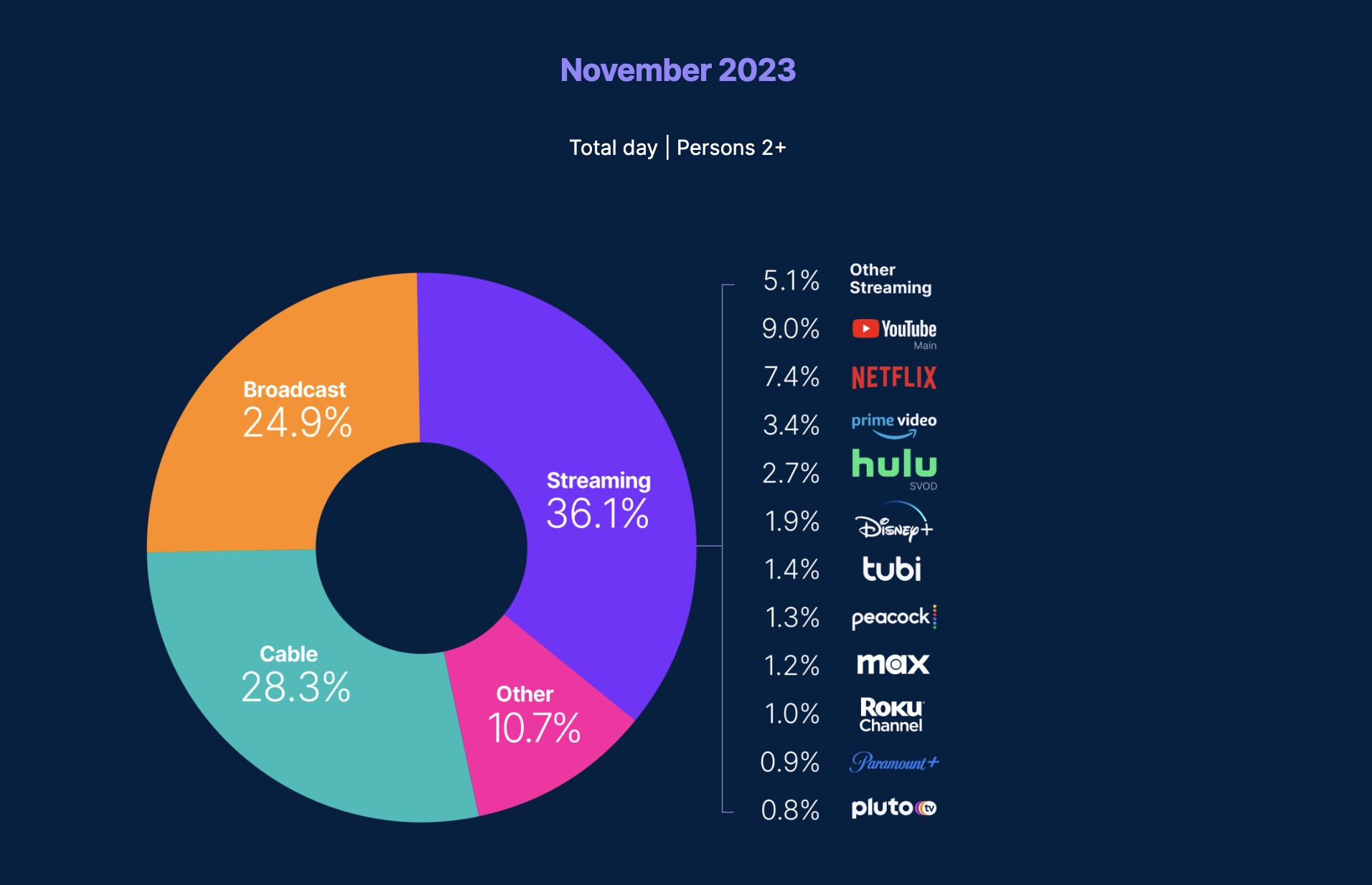

When we spoke to our Netflix source earlier this summer, we were given similar assurances that the data was not a complete representation of the state of Netflix's content library. In fact, we were told to look to Nielsen's "The Gauge," a monthly survey analyzing domestic TV viewing market share.

Notably, Netflix made up 7.4% of the streaming market share for the most recently published Gauge graphic, which covered November, down from 7.9% when we last referenced it in May for our June article.

Netflix ended 2022 with 230.75 million paying subscribers globally. It hasn't reported full-year 2023 numbers yet, but it ended the third quarter of last year with 247.5 million subscribers.

So if the streamer added subscribers, what’s with the viewership decline?

It could be the result of Netflix’s recent shift to advertising, and its crackdown on password-sharing.

“Most of their new subs, especially in the U.S., are from password sharers transitioning to paying subs because of Netflix's account-sharing lockdown,” noted Evan Shapiro, a TMT analyst. “So far, this hasn't increased churn for Netflix. But they did just raise their prices. If their viewing continues to fall, I would expect more subscribers to cancel more often. “

Netflix, like other streamers, is looking to grow its ad business, after releasing an ad-supported tier in November of 2022.

And with a reported reach of 15 million ad-supported subscribers, Netflix may not have the advertising reach of platforms like Hulu, but policy changes like price hikes from the streamer could expand that number quickly.

“The main problem for Netflix's ad business is the exceptional lack of usage on their ad-supported platform,” explained Shapiro. “So, one big goal of Netflix's price increase is to move subscribers to the less expensive ad tier, which makes sense. Except, if Netflix subs can't find enough to watch, no matter what tier they're on, they will churn.

“By the middle of this year, Netflix will have transitioned all their password sharers, and this will slow sub growth, especially in the U.S.,” Shapiro added. “If they can't stem the tide of viewing hours, and actually increase usage especially on their ad platform, one wonders where growth will come from by 2025.”

Jack Reid is a USC Annenberg Journalism major with experience reporting, producing and writing for Annenberg Media. He has also served as a video editor, showrunner and live-anchor during his time in the field.