No More Fear and Loathing Over Video Subscriber Losses

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Pay TV providers are set to report the worst year in their history in terms of video customer losses, according to a handful of analysts. Yet, despite the losses and the increases in cord-cutting, cord-shaving and cord-nevering, those analysts are probably more optimistic about the future of the industry than they have been in years.

Comcast kicked off the fourth-quarter earnings season Jan. 23, reporting a decline of 149,000 video customers. The rest of the sector is expected to report in the coming weeks, with AT&T going on Jan. 29, Verizon Communications on Jan. 30 , Charter Communications on Jan. 31 and Altice USA on Feb. 12.

Cord-cutting has been on the rise for years: 2019 was worse than 2018, which was worse than 2017 and so on. Evercore ISI media analyst Vijay Jayant estimated cable would lose about 1.96 million video customers in 2019, up from the 1.26 million it lost in the prior year. Satellite-TV providers would see their losses more than double from 1.2 million in 2018 to 3.25 million in 2019, mainly due to heavy losses at DirecTV. Jayant estimated that DirecTV would lose about 800,000 video customers in Q4, down from the 1.1 million it lost in Q3.

Video Losses Aren’t Troubling

“Interestingly, complacency doesn’t seem to be an issue with respect to video,” Craig Moffett, MoffettNathanson principal and senior analyst, said in a note to clients. “There, cable investors seem to be keenly aware of the downside to estimates. It’s just that they (appropriately) don’t seem to care very much.

“The age of worrying about video subscriber losses finally seems to be behind us,” Moffett added. “Good riddance.”

But the fourth quarter, like the quarters behind it, will be characterized by broadband growth. Jayant estimated that cable operators will continue on their path of accounting for more than 100% of overall domestic broadband growth, adding 832,000 customers in Q4 compared to the addition of 612,000 in the same period last year.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“Cable’s clear speed advantage in roughly half the U.S. is driving continued strong share performance,” Jayant wrote. Jayant’s optimism for the sector is shown in his “outperform” ratings on Comcast and Charter (the top-rated stock in his coverage universe). Evercore ISI analyst James Ratcliffe has an “outperform” rating on Altice USA.

The slowdown affecting over-the-top providers also is expected to continue. Jayant predicted that virtual multichannel video programming distributors (vMVPDs) like SlingTV, AT&T TV Now, Hulu with Live TV, fubo TV and Philo would gain about 804,000 customers in 2018, less than half of the 2.3 million additions the sector enjoyed in 2018.

For the full year, Jayant estimates, pay TV subscribers (including OTT, cable, satellite and telco) will have declined by about 5.4 million, more than three times the 1.5 million the sector lost in 2018.

On the flip side, total cable, telco and satellite broadband subscriber additions are expected to reach 2.8 million in 2019, up 12% from the 2.5 million additions in 2018. Cable broadband adds are expected to be 3.1 million in 2019 (up nearly 15% from 2.7 million in 2018) while telcos are expected to lose 402,000 broadband customers, an increase over the 342,000 the sector lost in the prior year.

Mobile Share on the Rise

On the wireless front, Jayant wrote that while telcos Verizon and AT&T still dominate, cable managed to take some share in 2019, driven by higher net additions at Charter and the launch of Altice USA’s aggressive offering late in Q3.

Jayant predicted that the postpaid wireless base, including cable operator customers, increased by about 2.2 million in Q4, a rise of 160,000 subscribers year-over-year and 560,000 sequentially. He believes cable operators (mainly Comcast, Charter and Altice USA) captured about 25% of postpaid net additions in Q4 2019, up from 17% in the prior year.

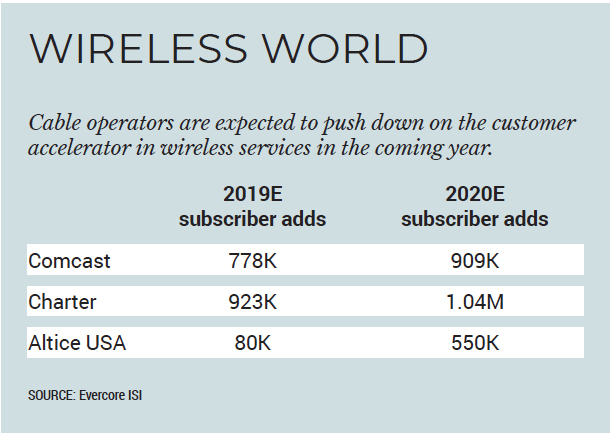

Wireless, primarily a retention tool for other cable services, is starting to break out of that box as subscribers rise. Charter added a surprising 276,000 wireless customers in Q3 (most analysts had expected a gain of about 230,000) and Jayant sees the momentum continuing into Q4, with 263,000 additions. Overall, he estimates Charter will add about 923,000 wireless lines in 2019 (up from 134,000 in 2018) and 1.04 million in 2020. He sees Altice USA stepping on the wireless accelerator in Q4, adding about 80,000 wireless customers in 2019, rising to 550,000 additions in 2020.

Wireless growth is expected to return to Comcast after a bit of a slowdown. Jayant predicted the largest U.S. cable company will add about 778,000 wireless customers in 2019 (down from 855,000 in 2018), rising to 909,000 additions in 2020.