Paramount Takes Its Lumps From Wall Street Analysts

Stock falls amid lower dividend, questions about streaming strategy

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Paramount Global stock took a beating after a first-quarter financial report that was disappointing to say the least.

Shares fell 28% to close at $16.40 a share, close to the stock’s 52-week low of $15.53 set last November.

“Before we bury the lede talking about the weaker fundamental picture highlighted by 1Q results, let’s focus on the real headline from this morning — Paramount cutting its quarterly dividend by 80% to just 5 cents” a share, was how MoffettNathanson reseaerch analyst Robert Fishman reacted to the day’s news.

While the dividend cut caused investors immediate pain, Wells Fargo senior equity analyst Steven Cahall wondered when things would improve if Paramount stuck to its streaming strategy.

“Management seems undeterred that streaming is the best path ahead," Cahall said. “We believe Paramount is worth a lot more either as a content arms dealer or as a break-up for sale story. Great content, misguided strategy. Downside risk remains until the strategy changes.”

At present, Cahall said, Paramount Plus is battling to be the No. 5 streaming platform in a crowded field and he doesn’t think Paramount will break even in streaming till 2027.

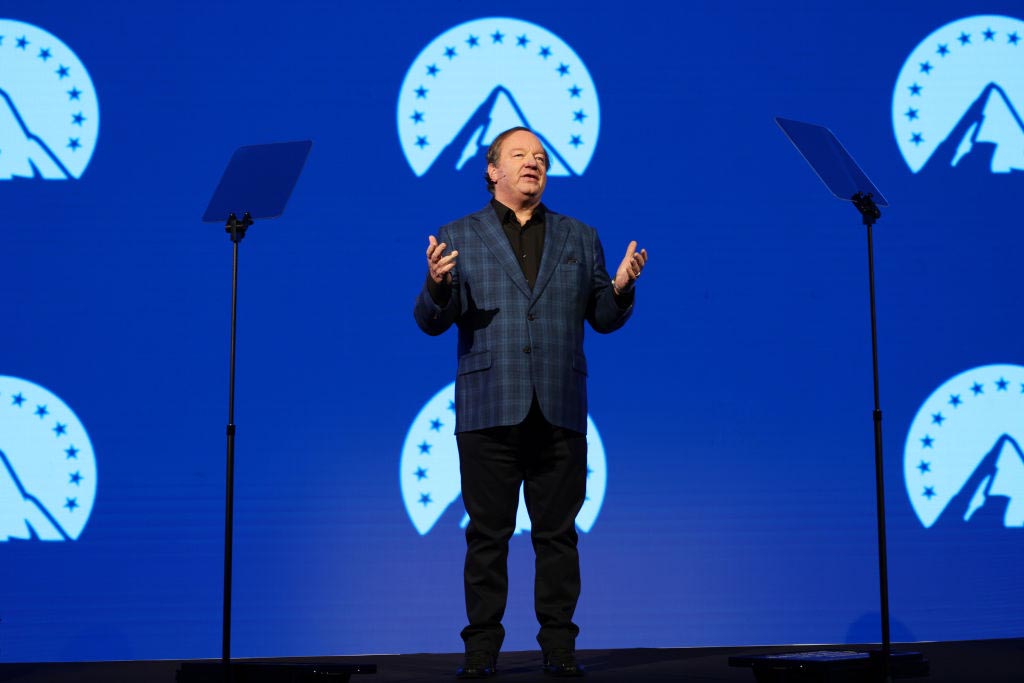

On Paramount’s earnings call, CEO Bob Bakish tried to get investors to look past the $511 million loss suffered by its direct-to-consumer business.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“2023 represents our peak investment year, but there is no question that our investment is producing results. And as we scale, we are very much on a related path to streaming profitability,” Bakish said.

Bakish noted that the company is “navigating a challenging and uncertain macroeconomic environment. And you see the impact of that in our financials, as the combination of peak streaming investment intersects with cyclical ad softness.”

But Bakish said facing those headwinds “makes us even more focused on making the necessary decisions to return the company to earnings growth and positive free cash flow in 2024.”

Fishman is not as sanguine. In addition to the loss at DTC, Paramount’s filmed entertainment business lost nearly $100 million and earnings at its TV Media business were down 15%, with a 11% drop in linear ad revenues, he noted.

“Fundamentals moving in the wrong direction and elevated levels of debt in a time of higher interest rates do not make for a healthy company under normal circumstances,” Fishman said.

He added that the dividend cut and the sharp drop in share prices could put the squeeze on Paramount chair Shari Redstone because the family holding company, National Amusements, used Paramount shares as collateral against its debt.

“The timing of the [dividend] cut is a surprise, but it is a rational decision to improve flexibility given the investment needs of the business and the balance sheet,” said Vijay Jayant of Evercore ISI. “However, investors are reacting to the dividend cut as reflecting an incrementally weaker financial outlook.”

Cahall continues to rate Paramount shares as underweight. He’s cut his estimates for operating incomes in 2023 and 2024 and reduced his expectations for free cash flow.

“We see earnings risk from ads, cord-cutting and less DTC improvement (we're especially skeptical of Paramount Plus driving ARPU growth) as the catalysts to further downside,” Cahall said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.