Plunging Paramount Defends Streaming Strategy

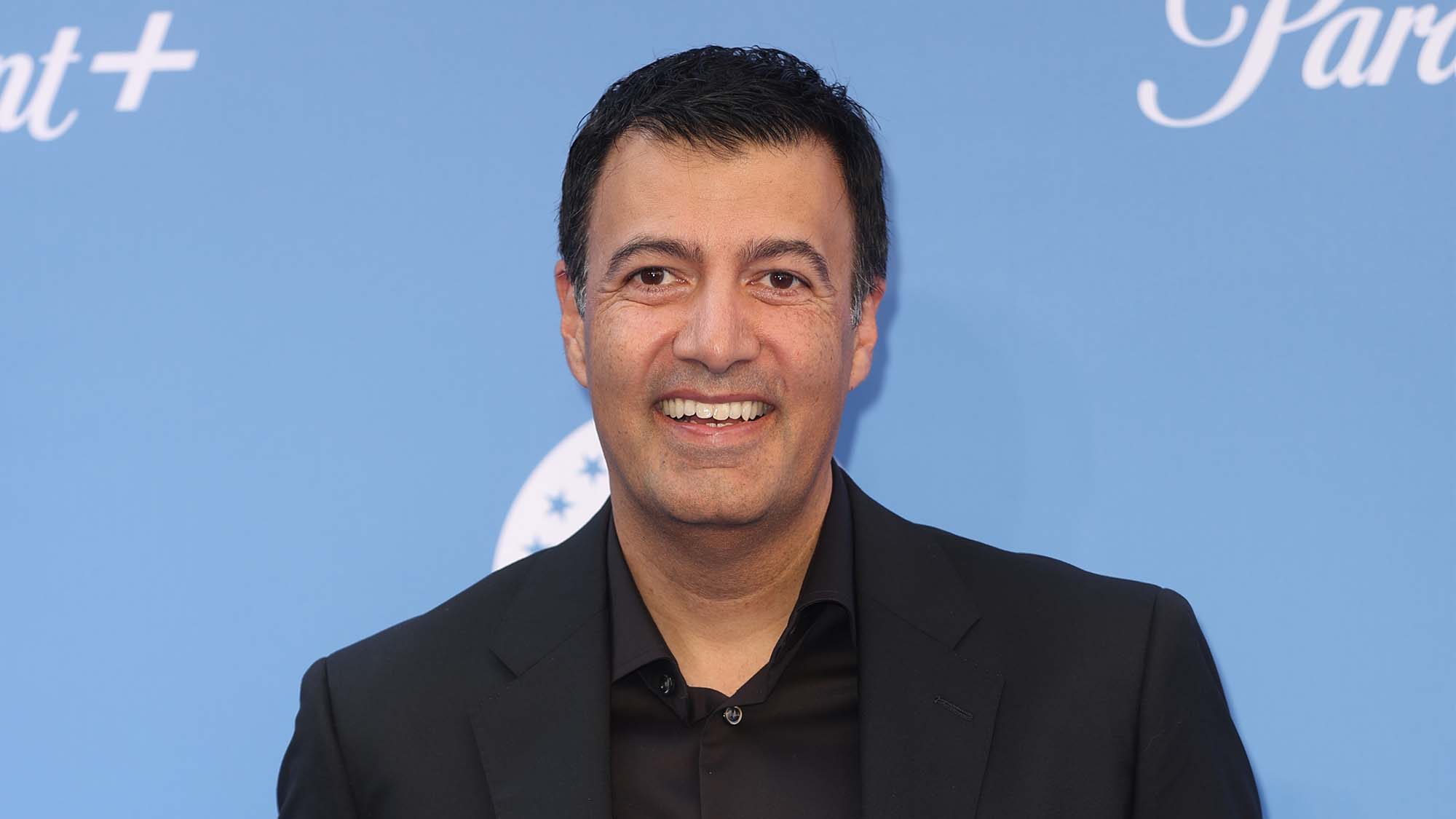

Streaming margins will approach linear, CFO Naveen Chopra says

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With its stock price plunging, Paramount Global defended its strategy of investing to try to become a player in the high-stakes streaming wars.

Paramount on Wednesday reported that third-quarter profits fell 57% as its direct-to-consumer businesses lost $343 million. The news helped send Paramount’s already depressed stock down about 10% in midday trading.

Wall Street soured on the shiny new streaming business after industry leader Netflix announced a loss of subscribers in the first quarter. Netflix’s stock plummeted, taking all of the traditional media companies looking to pivot to streaming down with it. The transition to streaming is expensive, requires scale and some analysts question whether Paramount is big enough to be a contender — especially as its traditional TV business erodes.

Also: Wells Fargo Downgrades Paramount Again, Says It Should Become an ‘Arms Dealer’

But speaking on Paramount’s earnings call Wednesday, CEO Bob Bakish and chief financial officer Naveen Chopra defended the company’s strategy.

Chopra told investors and analysts that streaming would be an important and financially rewarding part of the Paramount portfolio.

“Streaming offers a total addressable market which is more than twice the size of linear,” Chopra said. “The incredible ease of consumption with a vast array of content available at home or on the road, in whatever format you want, ad-free or ad-supported, means we can connect more consumers with Paramount content than ever before.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

This year, Paramount said it will exceed its expectations for direct-to-consumer growth of 75 million global subscribers.

That would mean more revenue.

“We expect streaming to be accretive to ARPU [average revenue per subscriber] over time. In fact, streaming ARPU already exceeds linear ARPU in some international markets,” he said, pointing to the U.K. as one example.

“It’s worth noting that there are streaming services in the market today with ARPU comparable to or higher than the monthly revenue we generate per linear household, and we believe Paramount Plus will achieve these levels of ARPU overtime with the implementation of price increases and continued growth and engagement and advertising monetization,” Chopra said.

Yes, price increases are coming.

“We definitely see opportunities to increase price on Paramount Plus and you will see us do that in the future,” he said.

"It’s fair to say that pricing is moving higher across the industry,” Chopra said. We think that means we have room to increase price and ultimately drive ARPU while preserving our value position relative to others.” Because Paramount Plus has different tiers and packages, including its Essentials tier, Chopra expects to be able to serve price-sensitive users and minimize churn.

Profitability will follow.

“We believe long-term operation margins in streaming will approach TV media margins,” he said.

Paramount’s multiplatform approach — combining linear and streaming, ad-supported and ad-free, along with theatrical distribution of films — will yield efficiencies in marketing, provide the company with promotion for Paramount Plus and provide more ways to monetize content. These cost efficiencies do not exist in a pure-play streaming business model, Chopra said.

Bakish acknowledged that in the short term, the company is facing macroeconomic headwinds that are hurting revenues by accelerating cord-cutting and depressing the advertising market.

But “we are also taking aggressive, precise actions to gain additional efficiency across our cable networks, streaming platforms, advertising sales, marketing and global operations,“ Bakish noted. ”These will yield cost savings next year as well as long-term strategic benefits.”

Specifically, Paramount has announced that its Showtime Networks, Showtime OTT and Paramount Television Studios operations have been melded into other Paramount units. The company also restructured its advertising sales unit and is making changes in its international unit.

Chopra said the cost-cutting efforts could lead to a fourth-quarter charge against earnings. He said the savings would be “meaningful and sizable,” but declined to attach a dollar amount to either the charge or the expense reductions Paramount is expecting.

Bakish noted that cost cuts would benefit Paramount when the economic cycle turns again.

After each downturn since 2001, he noted, there were quarters of particularly robust ad growth.

“Yes, we do have some macro-driven softness and all the people are talking about it, but as it always does, this market will turn around and that’s when you’ll see real benefit from our positioning as a market leader,” Bakish said. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.