Price Tag Is Key Piece Of Over-the-Top Puzzle

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The question of whether over-the-top video offerings will be successful in storming the pay-TV world might well depend on the prices players try to charge consumers.

A recent report from Wall Street research company MoffettNathanson says “it will be price that matters above all else.”

Both programmers and distributors are wading into the OTT subscription business, in part to capture young cord-never viewers and partly because it gives them a direct connection to their customers. Dish Network was early into the market with its low-price Sling TV. And CBS Corp. is betting big on CBS All Access and Showtime OTT offerings, estimating that if they attract 8 million subscribers by 2020 they will generate $800 million in incremental revenue. The entire market is waiting for Hulu to disclose the price of the live-TV service it plans to launch next year.

But for subscribers, one of the attractions of going over-the-top is avoiding the steep cost of a cable or satellite subscription.

“It is price that will determine whether content owners are better or worse off if customers defect from the traditional ecosystem for an OTT alternative,” the report says. “And it is price that will determine the negotiating posture of existing providers of linear distribution as they see OTT options emerge from their programming suppliers.”

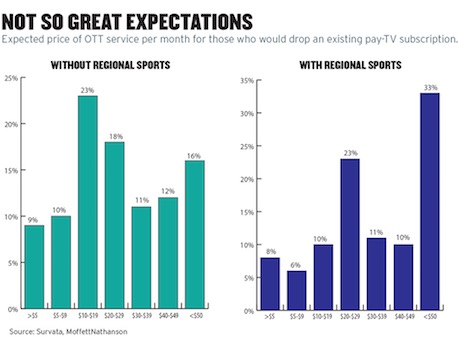

MoffettNathanson commissioned a study by Survata to test consumer expectation for a service such as Hulu. The survey looked at the service both with and without regional sports networks—which are important to many viewers but expensive programming for distributors.

The survey found that less than one-third of those that would consider subscribing to a streaming video service without RSNs would be willing to pay $40 or more per month, and if the price goes up beyond $50, demand falls off sharply. The majority would expect a service such as Hulu’s to cost $30 or less, with some expecting it to be less than $10.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Whether such a service is economically feasible at $40 is debatable,” the report says, highlighting the financial dilemma for potential virtual multichannel video programming distributors (MVPDs).

Another dilemma is that the people who say they would or might subscribe to an OTT service are evenly split between current pay-TV subscribers and non-pay-TV subscribers.

“Content owners considering OTT options universally cite their ability to appeal to nonsubscribers— without cannibalizing pay-TV subscription—as critical to their strategies,” MoffettNathanson notes. “Generally speaking, based on our survey at least, there is as much interest from pay-TV subscribers (cannibalization) as non-subscribers.”

Younger people were a more inviting target audience. The survey found that among 18-to-24-year-olds without an existing pay-TV subscription, 50% were willing to consider subscribing to an over-the-top service such as Hulu’s. Younger viewers with pay-TV were much less likely to consider OTT, possibly because their cable bill is being paid by their parents.

Subscribers were willing to pay a bit more if regional sports networks were included. In fact, live sports turned out to be pretty important. Among those surveyed, 14% more who had pay-TV would be willing to pay $40 or more for a streaming service if it offered live sports, compared to one that didn’t. The differential was similar among those without pay-TV.

Theses OTT streaming services do not seem to be much of a threat to Netflix. According to the survey, few Netflix subscribers saw a live-streaming service as a substitute for Netflix.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.