Shrinking of Viewers in 'Dollar Demos' a Growing Issue

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

They say youth is wasted on the young. But in the not-too-distant future, nearly half of TV may be wasted on the old.

With an army of baby boomers marching into their golden years and toward their couches, flat screens and remotes, an increasingly small proportion of TV viewers will be in the young demos that matter to advertisers.

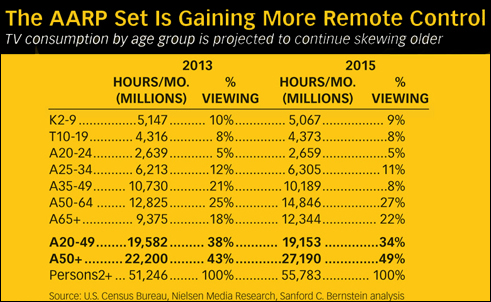

In a new research report, analyst Todd Juenger of Sanford C. Bernstein said that people 50 years and older will represent 34% of the U.S. population in 2015, up from 32% in 2011. And in 2015, those 50-pluses will represent 49% of all TV viewing hours, up from 43% in 2011.

That means the share of viewers in the 18-34 and 18-49 age groups—the “dollar demos” for ad sales—are shrinking. Juenger says viewers in the younger age groups have been decreasing their TV consumption by about 2% per year, while older viewers increase theirs.

“TV industry observers have watched this trend perpetuate for years at the broadcast networks, wondering when prices would finally reach a breaking point where marketers would move their dollars elsewhere,” Juenger said in his report. “It hasn’t happened, because there has been no substitute that could replace TV advertising for marketers. Online video advertising may change that.”

According to Juenger, “the growing CPMs of TV advertising against young demos, combined with the increasing availability and measurability of online video advertising which reaches young demos, accelerates the timeline—most acutely for networks targeting young viewers (think: MTV).”

Good News and Bad News

Juenger added that the trend is “a structural good guy in the short run.” In the short term, the scarcity of younger viewers means higher ad prices on a cost-per-thousand viewers (CPM) basis for the networks that deliver them. There is also the potential that marketers could embrace 50-plus audiences more.

But over the longer term, the trend is a bad guy. Rising CPMs for younger viewers will push CPMs up and eventually drive marketers to look for alternatives, including online advertising.

“TV networks have no obvious solution to deal with this,” Juenger said. “They can choose to try to capture more online dollars for themselves, but the more they encourage their viewers to eschew traditional TV, the more they hasten the demise of their core business—especially if it ultimately enables cord-cutting.”

That’s why TV networks are racing to get TV Everywhere up and running. “It holds the promise of satisfying the growing consumer desire to watch content anywhere, anytime on any device, while holding onto affiliate fees,” Juenger said. “But the longer it takes the [multichannel programming video distributors] and networks to bring forth workable TV Everywhere solutions, the more opportunity for interlopers to grab audiences and ad dollars, and potentially disintegrate the pay-TV system beyond repair.”

Same Old Story

The big broadcast networks have been looking for ways to start monetizing their older viewers. NBC has done research on what it calls Alpha Boomers—consumers in the 55- 64 year-old demo.

David Poltrack, chief research officer at CBS, the top-rated network but also the one with the oldest-skewing viewers, has trotted out research indicating that while a program like Blue Bloods has the highest median age of continuing shows on broadcast TV at 62.5, its audience also has a high concentration of heavy soft drink users, making it a counterintuitive buy for a soft-drink marketer— especially given a relatively low CPM.

CBS series The Good Wife, 60 Minutes, The Mentalist and NCIS all have median ages above 60, as do ABC’s Dancing With the Stars and Body of Proof. CBS’ youngest-skewing continuing show is How I Met Your Mother, with a median age of 47.2. The youngest-skewing series on all of the broadcast networks is Family Guy on Fox, with a median age of 30.6. The CW’s Gossip Girl has a median age of 32.

Poltrack said he is seeing an increased correlation between commercial prices and delivery of viewers 35-64 years old. But by and large the media buying community has stuck with 18-49 and 25-54 as the audiences they are willing to pay more to reach.

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.