Sinclair’s Stirr Reaches 1M Downloads in 6 Months

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Sinclair Broadcast Group’s streaming service Stirr has garnered more than a million downloads since its launch six months ago, exceeding the company’s forecasts.

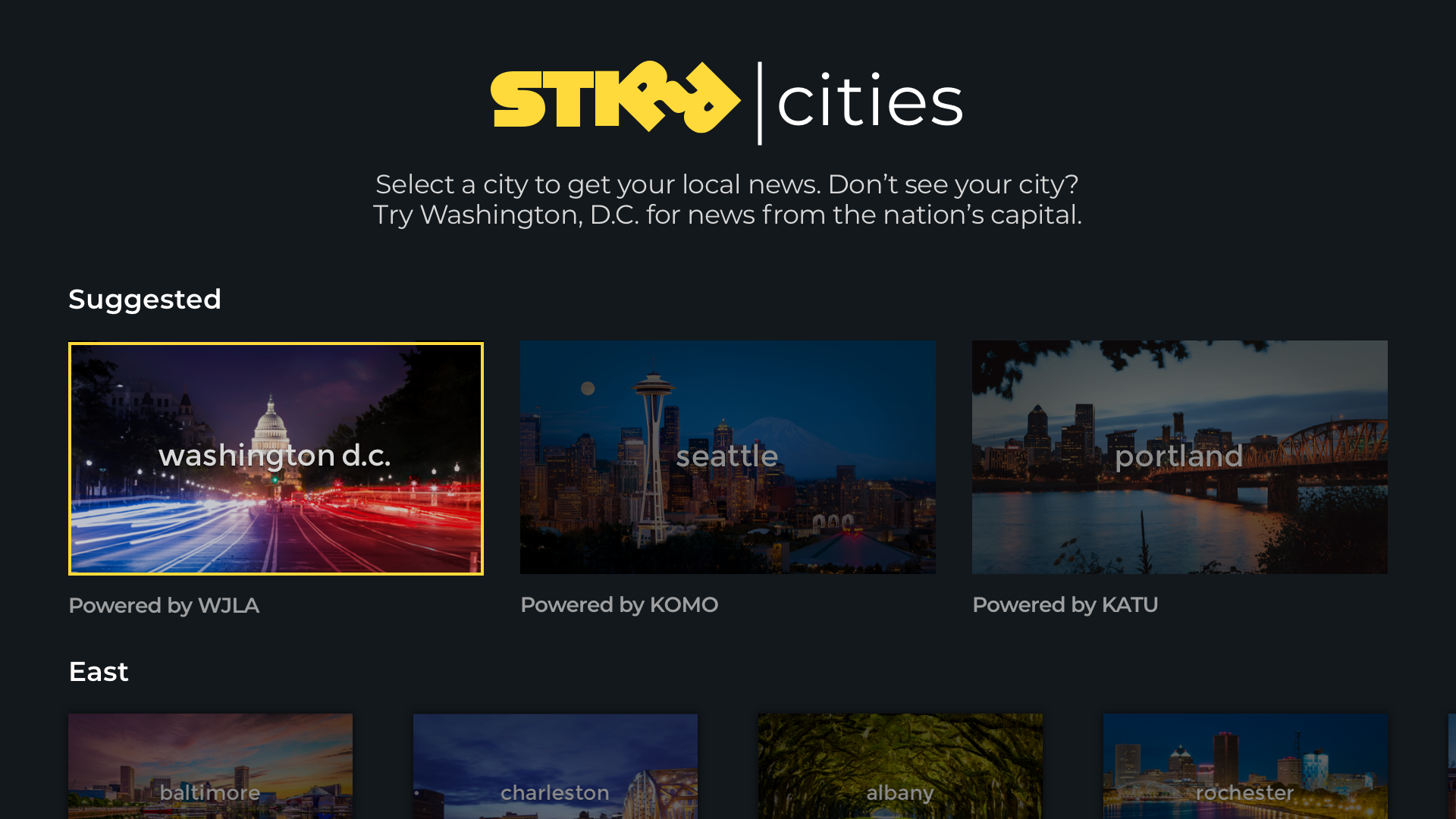

Most of the viewing is coming to Stirr’s linear channels and the most popular network is the Stirr City channel, featuring news from local Sinclair TV stations and other programming, according to Adam Ware, general manager of Stirr.

Ware said Stirr will soon be adding Stirr City channels for markets in which Sinclair does not own stations. He did not disclose which station groups Sinclair is talking to. “We’re getting a lot of interest from other broadcast companies that are quite interested in becoming Stirr City affiliates,” he said.

He didn’t elaborate on the financial terms, but it is likely that Sinclair will sell the ads on the streaming station and split the revenue with the station owner.

Related: Sinclair Looking to STIRR-up RSN Content

Stirr will also be adding 10 additional national networks. At launch Stirr had about 20 channels. Since launch, among the most popular is the game show network Buzzr.

Ware said Stirr hadn’t expected to reach a million downloads until the end of December. Connected devices led by Roku, Fire TV and Apple TV account for 76% of the download and 85% of Stirr viewership is coming through connected TV.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Viewership is up 200% since launch, with the average viewing session rising from 30 minutes at launch to 60 minutes now.

Viewing on Stirr City tends to peak during times when Stirr streams local station newscasts. At other times, the station runs acquired programming ranging from Hell’s Kitchen to the old Lucy Show. The programming is customized on a market-by-market basis using the instant viewing data available to over-the-top programmers. “It’s metered-markets on steroids,” Ware said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.