For Some, Fewer Spots May Mean More

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Complete Coverage: Upfronts 2016

This upfront season, some networks will have fewer spots to sell because they are reducing advertising loads to make shows more attractive to viewers, and more effective for advertisers.

Just last week, National Geographic Channel announced its shows will have 25% fewer commercials. Companies such as Viacom, which was notorious for how many spots it would stuff into an hour of programming, are touting their plans to reduce ad loads. In the short run, the strategy might put pressure on ad inventory and revenues, they say, but in the long run it should help the networks—and TV in general.

“We believe that will improve our brand health overall and help us as we go into the upfront where we’d like to be very strong,” Viacom CEO Philippe Dauman said on a recent earnings call with analysts. Viacom is focusing its ad cuts in primetime on some of its networks.

Related: Network Sales Execs Expecting Big Upfront

Time Warner’s Turner Broadcasting last year announced plans to sharply cut the amount of commercials on its truTV network. It is also cutting the number of ads in new original programs on TNT—which translates to more content for viewers.

“We are not doing it to lose money. So we fully intend to provide increased value per inventory unit that we sell,” said Turner CEO John Martin. “Now it’s up to us to demonstrate that, but we are actively going to be moving beyond the 30-second spot business to create innovative new ad products for our advertisers and marketers.” Instead of 30-second spots, Turner will be running branded content and boosting its social media efforts.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“One of the reasons why we are starting with this commitment on truTV is obviously it’s a network where we have less advertising exposure than some of our larger networks like TBS and TNT. Having said that, the type of approach and ideology that we have with truTV, which we think will succeed, we’re already beginning to plan for on some of our other networks,” said Martin.

Related: For Media Buyers, It’s Telemundo + Univision

Less Said the Better

For media buyers and advertisers, less clutter in shows would seem to be a plus. The question is how much is it worth?

Dave Campanelli, senior VP, director of national broadcast at Horizon Media, said ad loads will be on the table during negotiations.

“It will be a factor, yes. Networks are looking for advertisers to pick up the cost of the lower ad loads. However, advertisers never got rollbacks as ad loads increased throughout the years, so that will be a point of contention,” Campanelli said.

“From the viewer perspective, the lower loads are a good thing,” Campanelli added. “I think it will take time though. There won’t be an immediate rating bump due to lower ad load, but over time it should benefit ratings.”

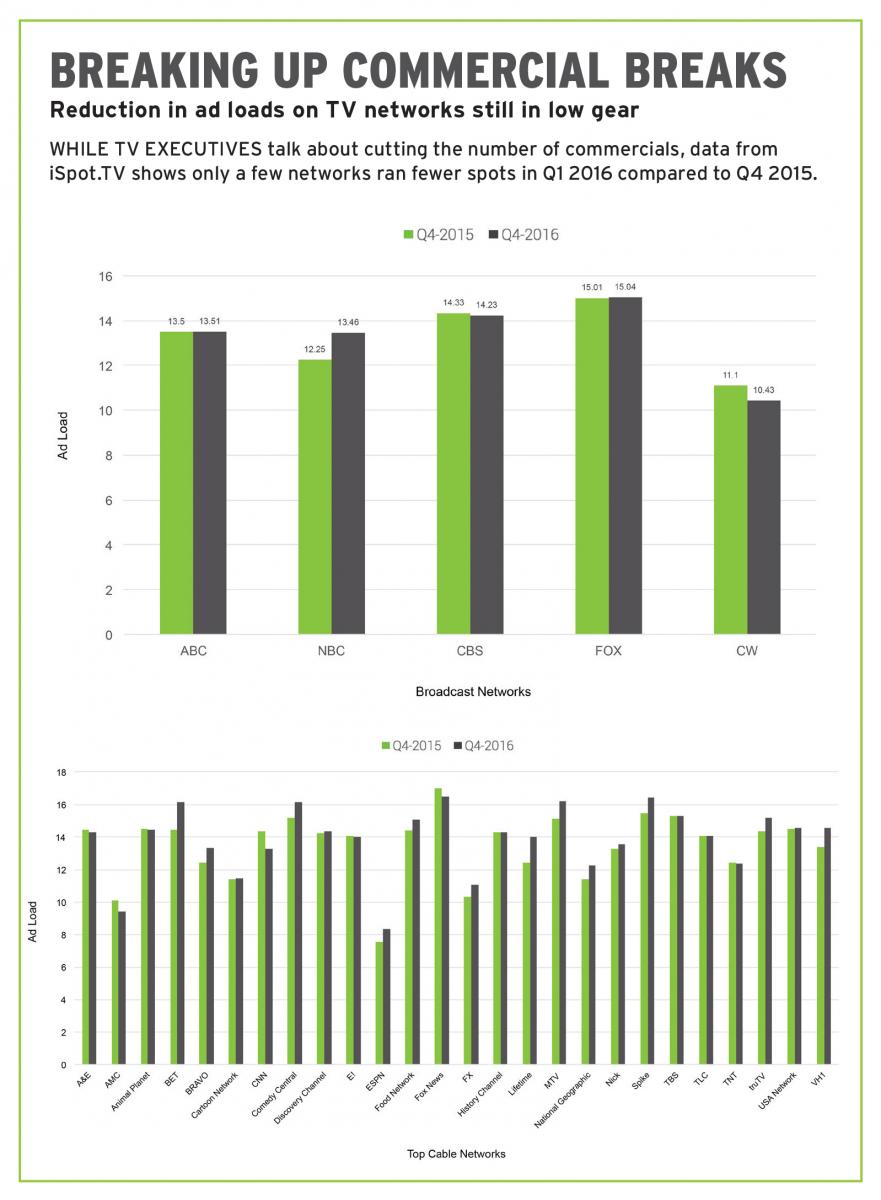

Despite all the chatter, only a small portion of networks actually aired fewer spots during the first quarter, compared to the fourth quarter, which seasonally is a busy one for advertisers (see chart, opposite page). Analyst Todd Juenger of Sanford C. Bernstein similarly found that across TV, ad loads fell only 1% during the first quarter compared to a year ago.

How Low Can Ad Loads Go?

“I wouldn’t be able to predict today what the ideal ad load is two years from now, three years from now, four years from now. We would say the experience that we have is that the advertising loads are highly relevant to the customer experience, there is no question about that,” said James Murdoch, CEO of 21st Century Fox.

Murdoch has emphasized ad innovation as a priority for the Fox broadcast and cable networks. Fox’s top-rated show, Empire, airs with a reduced commercial load, which might be contributing to its popularity.

“There’s no question in that we invest a lot in programming and we invest a lot in achieving a suspension of disbelief amongst our customers as we create the cinematic kind of experiences for them,” he said. “And then we jerk them out of that environment to show them advertising. That’s obviously necessary economically in many cases.”

Some of the competitors to traditional TV, such as Netflix, have no ads. Hulu, the over-the-top subscription video-on-demand service in which Fox owns a stake, has a relatively low ad load. It has also offered subscribers a more expensive ad-free option. The fact that not all subscribers have gone the ad-free route means that consumers understand how advertisers help pay for the content they enjoy, Murdoch said.

“So we think some will pay a premium in that environment to have no ad load, some will value the lower ad load that exists on Hulu today for example than in the broadcast environment,” he said. “And I think in a streaming environment, the real opportunity here is to have better pricing and more targeting across the piece, which allows us to continue to reduce the ad load as more video shifts and more consumption shifts to the IP streaming platform.”

Not all programmers think cutting ad loads is the way to go, however.

“Our ad load has been really consistent for long periods of time. We have no intention of changing that, adjusting up or down,” said Burt Jablin, COO of Scripps Networks Interactive. “We think we have the right ad load, have had it for years, and we’ll stay that way.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.