Speciale Sees Industry Turning to Data-Driven Audience Future

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

WHY THIS MATTERS: Cable networks see data and lower ad loads as ways to compete in the upcoming upfront market.

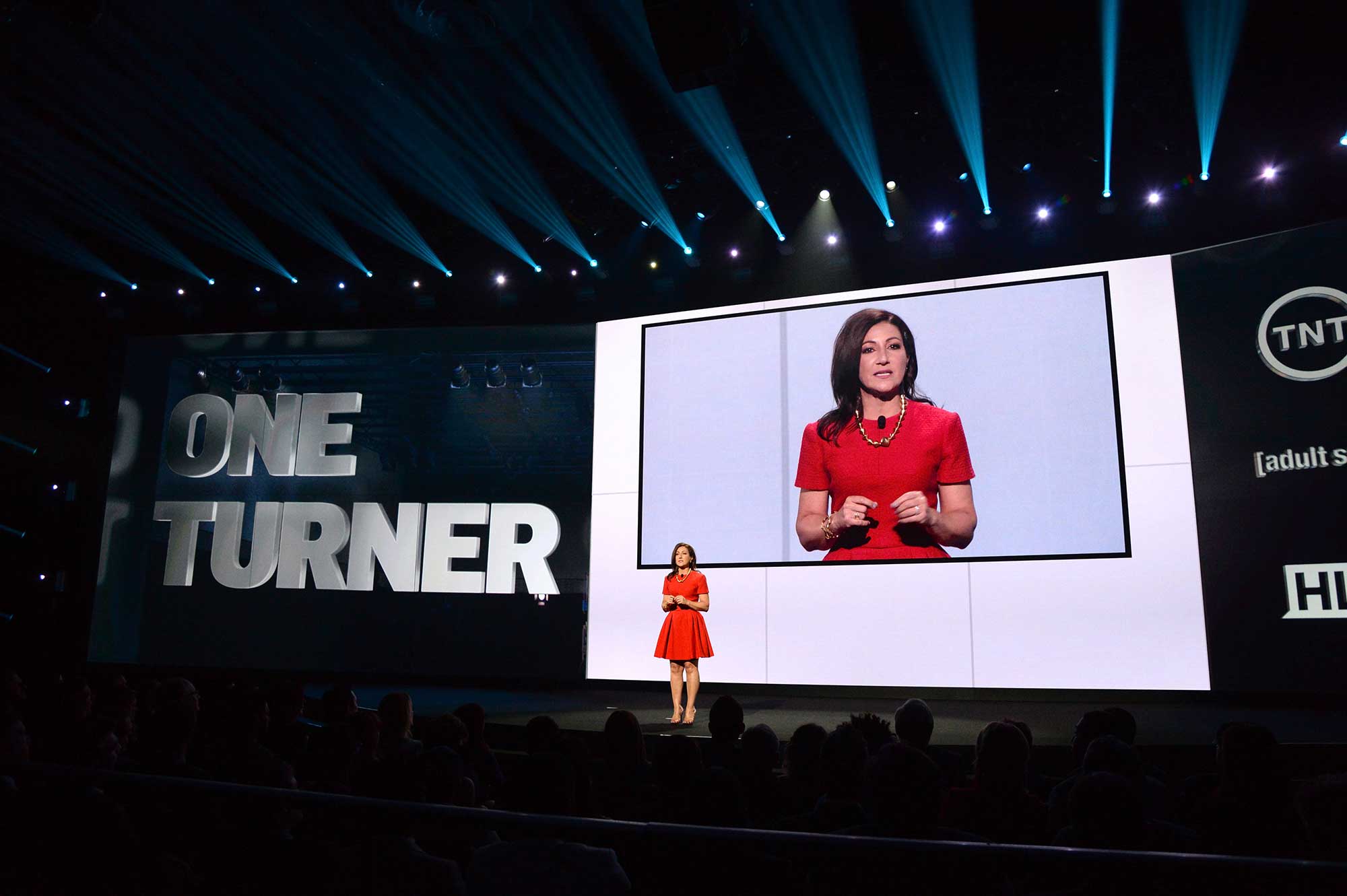

As another upfront approaches, Donna Speciale, Turner’s president for ad sales, is happy to hear that more programmers are picking up on themes that she’s been pitching for years.

Turner was an early adopter when it came to using data to help clients target likely buyers of their products across its portfolio of networks.

It was also among the leader in talking about improving the TV consumer’s experience by cutting back on commercials, first on truTV, then on original programs on TNT and TBS.

Both of those topics are likely to be big talking points during upfront discussions, if not big business drivers during negotiations with media buyers.

Already this year, Fox and NBCUniversal have made big announcements about their plans to cut commercials. Fox, which someday hopes to get down to two minutes of commercials per hour, is planning to have its Sunday shows feature commercials only in special two-spot pods. NBCU promises to cut the ad load in original primetime programming on its networks by 10%, with 20% fewer commercials during each break.

At this point, Speciale isn’t exactly saying I told you so. But she does see the industry moving in the direction in which she has already tried to set up shop.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The TV Experience Matters

With regard to the NBCU and Fox announcements, Speciale said she’s pleased.

“I feel like finally maybe everybody in the marketplace is now realizing that the experience is obviously really important, there’s a lot of choices that our viewers have, whether it’s Hulu, Amazon, Netflix, all of our properties,” she said. “Now, I feel like everybody’s realizing that in order for us to really fix this and fine-tune it, we all kind of have to do this together.”

Improving the experience goes hand-in-hand with adding data to the ad-sales mix.

“It’s all connected,” she said. “It wasn’t one without the other. You need every piece that we have been building and all of our capabilities.”

A dash of creativity is required, as well, in commercials and branded content. “We need better storytelling for the experience of the entire show,” Speciale said. “I think it will lift all boats.”

Will Turner’s boat be lifted a little higher because Speciale was a little ahead of the pack?

“Turner has definitely been benefiting,” she said. “We’ve been getting our fair share across all of our networks.

“What I see happening at some point in the marketplace is, and this has been happening for a while, marketers have been wanting to align to fewer partners,” Speciale added. “We have been leading in the marketplace and marketers want to go with partners who are going to take them to that next evolution of what our business is.”

After possibly being ahead of the game, the future is here for Turner, Speciale said. “And marketers can’t wait any longer either. We’ve been seeing a lot more marketers coming into the audience space. Open AP has definitely helped that.”

Open AP was set up to help advance audience buying by standardizing how clients define their target markets and by providing post-campaign analyses that show the effectiveness of data-driven campaigns.

A year after it was set up as a consortium among Turner, 21st Century Fox and Viacom, Open AP still has only three members heading into the upfront.

“I’m hoping that prior to the upfront there will be some more announcements,” Speciale said. “Stay tuned.”

Last spring’s Open AP announcement came before the project was fully ready to go. But it was a tough secret to keep and “it needed to get out for the marketers to realize we were very serious,” Speciale said.

In the meantime, the Turner ad sales president pointed out that clients who have tried data-driven, audience-based campaigns have come back for more and increased their spending. “We’ve increased every single year,” Speciale said. “Same advertisers, bigger budgets. More advertisers have come into the network and are doing it. It’s been great.”

Turner said clients who do audience buying are spending 25% of their total budget on audiences. The return on investment is big, an average of $5.66 for every dollar spent, representing a 122% increase over the ROI delivered by standard demo deals.

But a lot of other marketers haven’t taken the leap into data and audience buying.

“It’s hard,” Speciale said. “It’s not easy. It’s a little complicated. And there’s a lot of training, which is what we’ve been focusing on.”

Internally, many clients have procurement people who need to compare next year’s plan with the current plan. If there’s no history on data-driven advertising, it is hard to get it approved.

“You only need to do it once. Once you do it, they you have history. Then you can start comparing it. And don’t forget: Everybody has renewed. So, for everybody who has been dipping their toe in, it’s not even experimental anymore. Now they’re using it.”

Data helps TV compete against digital and TV has to press its advantages at a time when Facebook and Google are being questioned by advertisers.

During its upfront, Turner will again focus on the concept of fans.

“What is true is that our fans want this content no matter where it is, no matter what screen it’s on,” Speciale said. “And I think everybody knows that. So if you’re watching Conan, and you want to watch it online, you watch it online. If you’re seeing clips on YouTube, you’re seeing clips on YouTube. It’s happening. The behavior of the viewer and the consumer is definitely on all screens. We just all have to figure out, especially for media companies — how do I get paid for it?”

Searching For a Metric

They can’t get paid on it based on Nielsen ratings. “We shouldn’t be sitting here making a Nielsen metric the success metric, because those days are over,” Speciale said. “That metric isn’t true to what the marketers are looking for. They want that engaged fan. They want that fan that is passionate and rapid for their product and my product. When we can find those connections, that sells product.”

By now, Turner was hoping it would be swimming in data provided by AT&T, but the telco’s proposed acquisition of Turner parent Time Warner is in limbo because of opposition from the Trump administration. A Justice Department lawsuit is now being tried in court.

At this point, being part of AT&T, or not being part of it, isn’t affecting Turner’s upfront planning, according to Speciale. “Everything is business as usual,” she said. “We’ve just been putting our heads down and focusing on everything we’ve been focusing on. Nothing’s really changed.”

Looking ahead, Speciale said she sees momentum as the upfront approaches. Because of transparency issues with digital, some advertisers’ dollars are swinging back to TV.

“They’re not going to be taking all their money off of Facebook or Google,” she said. “That wouldn’t make any sense. But I do believe we’re going to be seeing a bit more of a shift of wanting better value wanting better quality premium video and knowing what they’re actually getting.”

And that should benefit a forward-looking TV company like Turner. “I think clients are really pleased with the stance and our vision of where the marketplace is and they want to partner with companies like ourselves who are seeing that evolution and are pushing the market toward the place where we need to be,” she said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.