Streaming Ad Views Increased 50% in First Half of 2021: FreeWheel

Connected TV has 60% share

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Streaming TV ad views increased 50% in the first half, according to a new U.S. Video Marketplace Report from Comcast’s FreeWheel.

FreeWheel said that 75% of its ad views are now seen on the big screen, with 60% on connected TV devices and 15% on set-top-box video on demand. The rest are seen on mobile devices and desktop computers.

Roku has a 43% share of connected TV ad views, followed by 26% for Fire TV, 8% for smart TVs and 7% for Chromecast.

Streaming services accounted for 45% of ad views, followed by 36% for TV Everywhere apps, 15% for set-top-box VOD and 4% for virtual MVPDs.

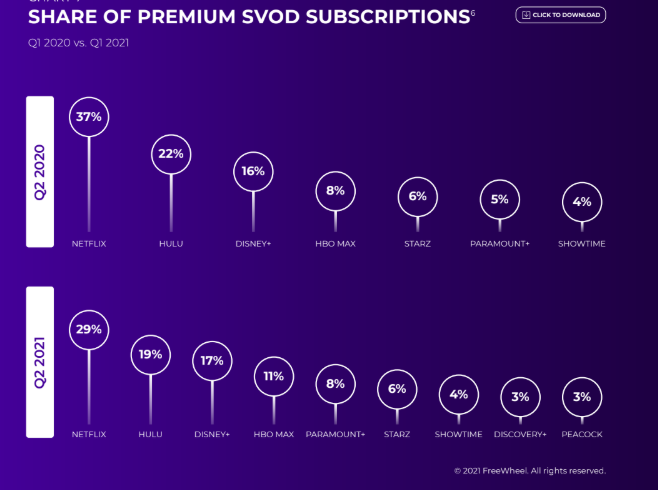

By FreeWheel’s count Peacock, Comcast’s streaming service accounted for 3% of premium SVOD subscriptions. Netflix was tops with 29%, followed by Hulu at 19%, Disney Plus at 17%, HBO Max at 11%, Paramount Plus with 8%, Starz with 6%, Showtime with 4% and Discovery Plus with 3%.

FreeWheel saw an 84% uptick in programmatic transactions. In the first half 24% of premium video ad views were bought programmatically.

Behavioral targeting by advertisers also increased, with 60% of ads bought based on behavioral segments, compared to 40% targeted by demos.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

FreeWheel said that 92% of its streaming ad views came in entertainment programming, with news accounting for 5% and news 3%. FreeWheel noted that Paramount Plus and Peacock were increasing the amount of sports programming they stream, while AT&T’s WarnerMedia is getting set to launch a CNN Plus streaming news service next year.

“The first half of 2021 was an interesting and pivotal time in terms of viewership trends and how the industry responded. One example was the rise in programmatic transactions, as buyers sought greater flexibility, in this year’s upfronts,” said Comcast Advertising VP of Marketing James Rothwell. “As these new consumer behaviors and advertising tactics become habitual, we’re expecting many of these trends to continue fueling the pace and development of new technologies, innovations and ways of reaching and engaging viewers.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.