Streaming Climbs to Record Share As Total TV Usage Dips in May

‘Young Sheldon’ racks up 6 billion viewing hours — half on linear TV, half on streaming

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

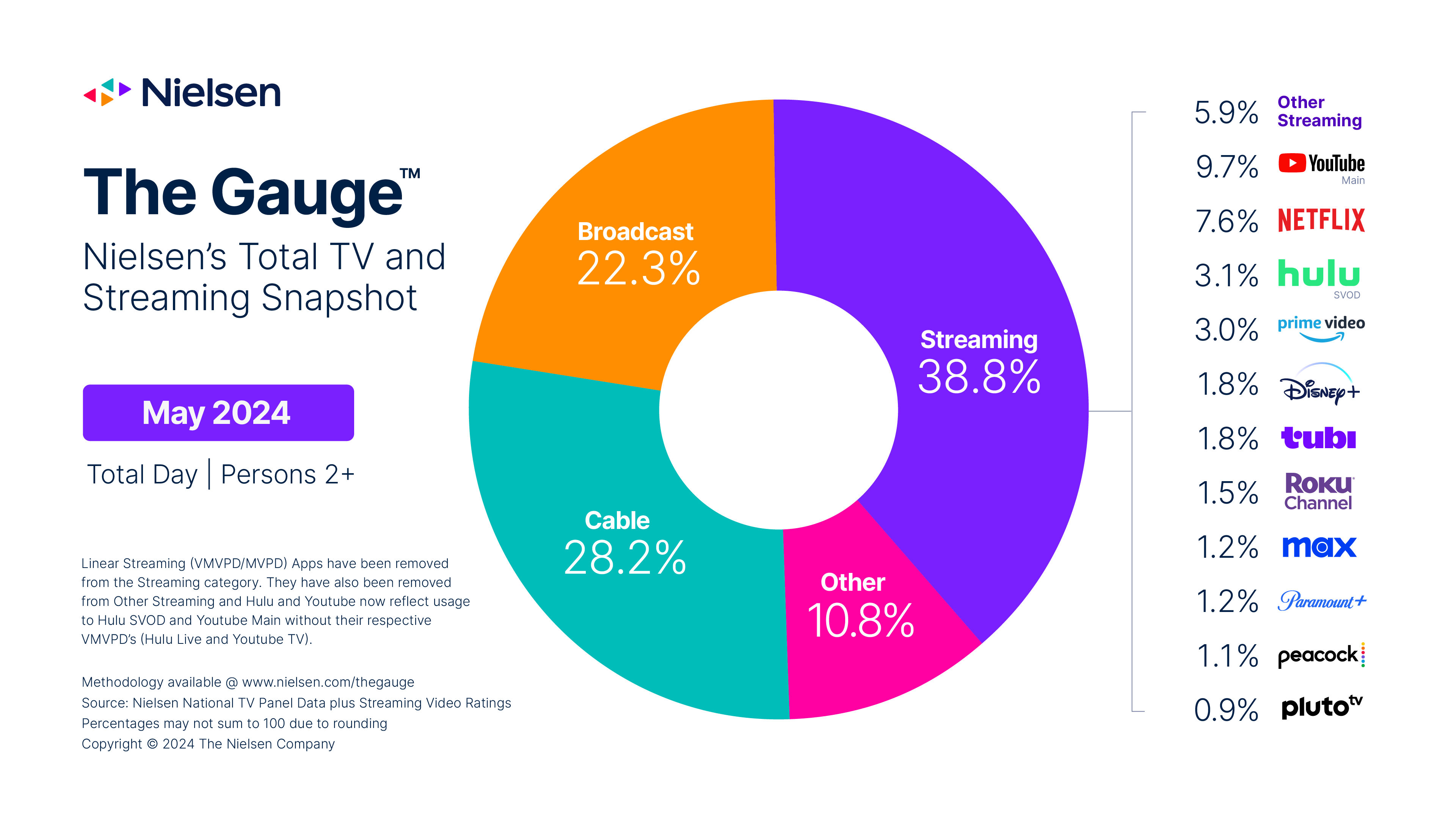

Streaming grabbed a record high 38.8% share of television usage in May as total usage fell 2.4% from April, according to Nielsen.

Nielsen said the sitcom Young Sheldon presented a strong example of how TV is converging. The series generated 6 billion viewing hours, with half coming on streaming and the other half on traditional broadcast and cable TV.

Young Sheldon appeared on CBS, TBS, Nick at Nite, Paramount Plus, Netflix and Max. It ended its first run on CBS on May 16.

With season finales airing, broadcast’s share of TV usage rose to 22.3% of viewing from 22.2% in April.

Broadcast also got a boost from NBC’s broadcast of the Kentucky Derby, the most-watched linear telecast May.

Compared to a year ago, broadcast’s share was down 0.5 points.

Cable’s share fell to 28.2 from 29.1% in April. With no March Madness and fewer sports telecasts overall, not only was cable down from April, but its share was down 0.5 points from last year.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Helping streaming’s share rise from 38.4% in April was growth at free, ad-supported platforms Tubi, The Roku Channel and Pluto TV. Fox-owned Tubi’s share equaled that of Disney Plus.

YouTube again was the top streaming service with a 9.7% share in May, compared to a 9.6% share in April.

Netflix had a 7.6% share, unchanged from April..

Hulu’s share was 3.1%, unchanged; Amazon Prime Video was 3.0%, down from 3.2%; Disney Plus was 1.8%, unchanged; Tubi grabbed a 1.8% share, up from 1.7%; The Roku Channel generated 1.5%, compared to 1.4%; Max had 1.2%, unchanged; Paramount garnered 1.2%, up from 1% Peacock had 1.1%, down from 1.3% and Pluto TV had 0.9%, up from 0.8%

Bridgerton on Netflix was the most-streamed programing, capturing 5.5 billion viewing minutes as the first four episodes of Season 3 dropped.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.