Strong Ad Market Means Smaller Drop in TV Revenues, Says Magna Forecast

Elections, Olympics add $10 billion in spending

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

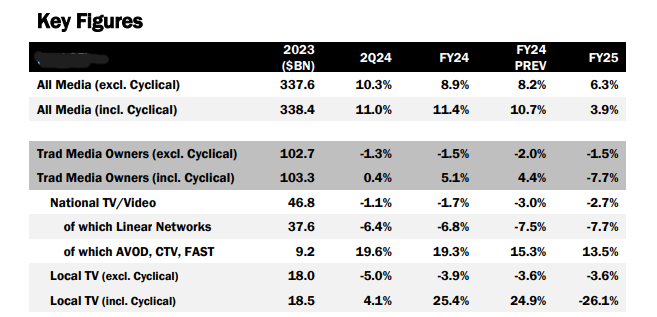

A stronger-than-expected U.S. advertising market and special events meant smaller declines in national TV ad revenues in the second quarter, according to media agency Magna, which boosted its full-year ad spending forecast for 2024.

National television/video revenues fell 1.1% in Q2. That included a 6.4% drop for linear networks and a 19.6% increase for ad-supported video-on-demand, connected TV and free ad-supported streaming television (FAST).

For 2024, Magna forecasts that national TV will finish down 1.7%, an improvement from Magna’s earlier forecast of a 3% decline. Linear networks will be down 6.8% while AVOD, CTV and FAST will be up 19.3%.

Local TV is expected to be up 25.4% in 2024 including cyclical events, and down 3.9% excluding cyclical events.

For all media, Magna sees ad revenues including cyclical events as rising by 11.4% (the previous forecast was 10.7%) and up 8.9% excluding cyclical events (the earlier forecast was 8.2%). That would mark the strongest growth rate in 20 years.

Those cyclical events will bring in $10 billion in incremental ad sales in 2024. The election will add a record $9 billion to media owners. Magna estimates NBCUniversal’s ad sales during the Paris Olympic Games at $1.5 billion, including $1.1 billion for linear and $400 million for digital and streaming.

On the digital side, ad revenue rose 16% in the first half of 2024. Magna noted that Meta and Google credited AI tools with driving incremental spending.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

For the full year, digital pure-play ad revenue is expected to be up 14.2% in 2024.

Magna also forecasts that the ad market will remain strong in 2025.

Overall, noncyclical ad spending will grow 6.3% to $291 billion in 2025, Magna said, while sales including cyclical events, like the Olympics and elections, will rise only 3.9%.

National television sales will drop 2.7% while local television sales will underperform and decline 3.6% (excluding election spending) in 2025.

Digital pure players will again drive the market, growing 9.3% to $289 billion, while traditional media owners will erode by 1.5% to $102 billion.

Digital revenues are expected to be up 8.7% in 2025.

In 2026, the ad market should top $400 billion, the agency said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.