Total TV Ad Revenue Forecast Flat in Post-Election 2021: GroupM

Excluding political, media buyer sees 10.5% gain

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Total television advertising revenue in the U.S. is expected to be flat at $64.1 billion, a strong post-pandemic performance for a non-election year, according to media buyer GroupM.

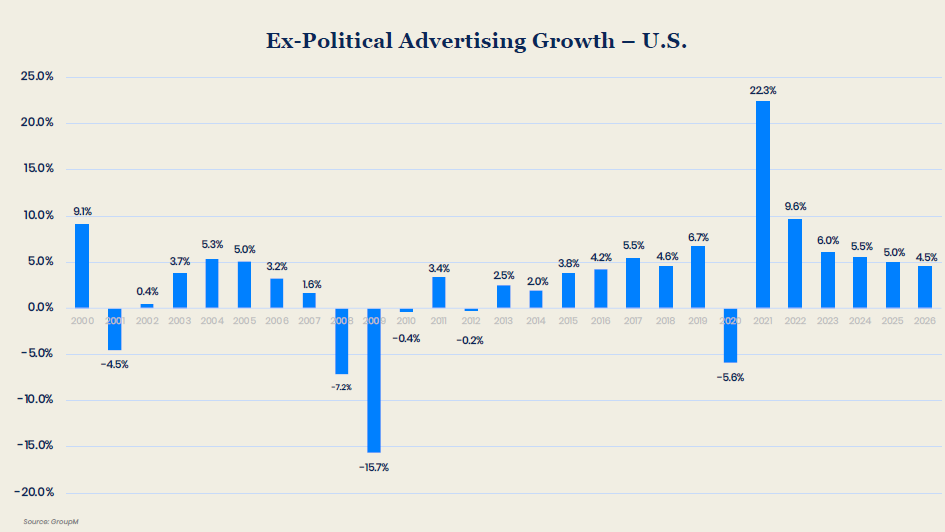

Excluding political spending, ad revenue for 2021 will jump 10.5%, reversing a 10.4% decline in 2020, GroupM said.

GroupM’s numbers include digital extensions of television, what the agency calls “Connected TV Plus,” which will account for about 15% of spending in 2021 and climb to 35% by 2026.

Going forward, GroupM sees total television spending, excluding political, slipping 2.3% in 2022, edging up 0.8% in 2023, falling 1% in 2024, dipping 0.2% in 2025 and finishing down $1.5% in 2026 at $60.5 billion.

“Television faces countervailing pressures that negatively affect its media owners on the margins; however, advertising is set to remain relatively stable following a year of recovery-driven growth,” GroupM said in its This Year Next Year report.

GroupM notes that large brands that advertise on TV will mostly maintain their spending as ratings fall and prices rise. Any losses are offset by newer brands, including the digital giants.

“Total spending is unlikely to change by much as long as television is better than the next-best alternatives at delivering on brands’ marketing goals,” the media buyer said. “New approaches to managing reach and frequency with linear and connected TV plus inventory will go a long way toward ensuring this.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

National TV revenue excluding political are forecast to grow 8.7% to $43.4 billion in 2021, GroupM said. Nation revenues will be flat in 2022 and wind up slightly lower at $43.2 billion in 2026.

The forecast for local TV ad revenue calls for a 14.8% increase to $19.8 billion in 2021 excluding political. In 2023, a 7.3% drop is expected, with revenue of $17.3 billion in 2026.

“National TV will continue to outperform local TV on an underlying basis (excluding political spending), much as it has for many years, due to the economy’s increasingly national—rather than local—orientation among businesses,” GroupM said.

Overall GroupM sees 2021 as a comeback year for advertising. It expects 22% growth in media ad revenue to $279 million (excluding Political) and expects the gain to continue through 2026, when revenue will hit $388 billion.

GroupM expects digital advertising (excluding political advertising) to increase by 33% in 2021, building on last year’s 10% growth. At this pace, digital will account for 57% of all advertising in the U.S. By 2026, digital advertising will continue to outpace the overall market, accounting for 69% of the industry.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.