Univision to Play on ‘Passion’ in Upfront

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

While other networks offer data, Univision is now pushing the passion.

At this year’s upfront, the Spanish-language giant’s mantra will be “Proof of Passion” as it tries to take advantage of a ratings turnaround.

Over four years, Univision’s primetime ratings dove about 30%, putting its historic dominance in jeopardy. Viewers said the telenovelas from Televisa in Mexico, long a strength, seemed stale and dated, particularly compared to the more modern, made-in-America offerings from Comcast’s Telemundo.

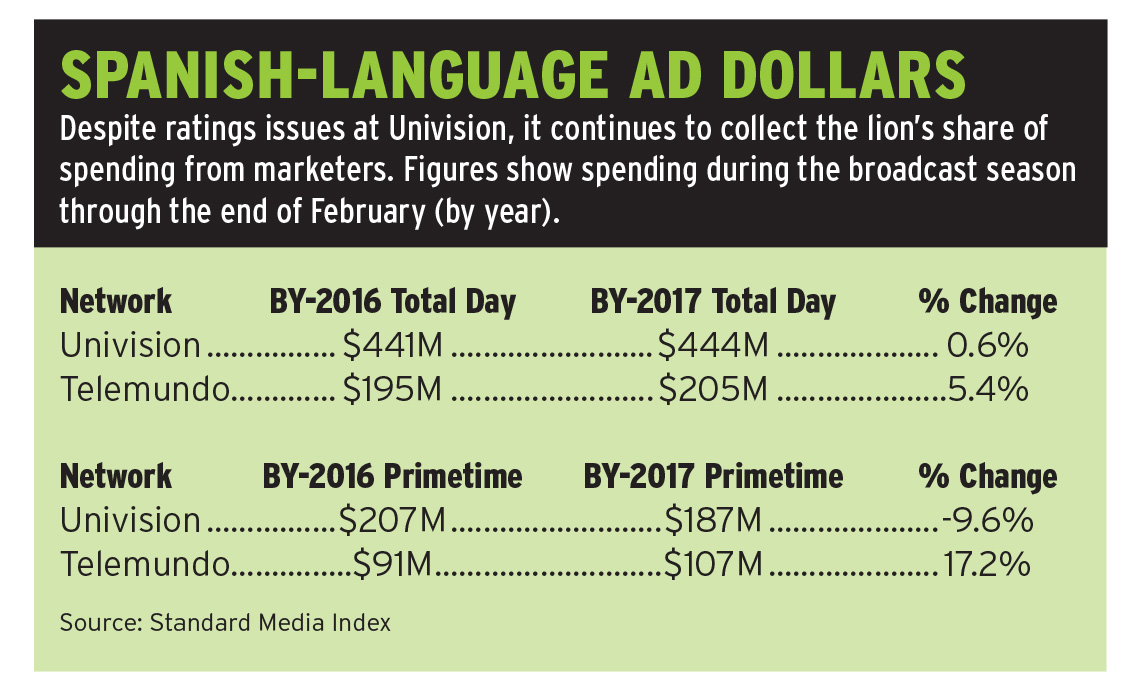

As a result, while Univision maintained its huge lead in ad revenue, Telemundo has been growing faster. Through February this season, Univision’s broadcast primetime ad revenue was $187 million, compared to $107 million for Telemundo. But Univision was down 9.6% compared to the prior year. For total day, Univision’s $444 million in ad revenue more than doubled Telemundo’s total, and was up 0.6% from the prior year.

“I think the difference this year is we’ve got some real ratings momentum,” said Univision ad sales president Keith Turner.

Last year, Univision’s content chief, Isaac Lee, was also named head of content for Televisa, which owns a big stake in Univision. Univision also named Lourdes Diaz as president of entertainment. And in addition to the Televisa programming, the company began producing its own shows.

Turner says Univision’s new programming—shows such as La Piloto, from a joint venture with producer Patricio Wills, and El Chapo, a coproduction of Univision’s Story House and Netflix—is fresher and younger. The telenovelas run on shorter cycles. And women are being depicted as more empowered.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Because of the changes, Univision’s ad sales team will get earlier looks at upcoming programs, and can then create opportunities for integrating clients into shows and suggest other marketing tie-ins. “Nobody just wants to buy 30-second commercials anymore,” said Turner, “so we’ll have that advantage going forward.”

Turner also plans to sell Univision’s sports and news programming. While Telemundo will be taking over the 2018 FIFA World Cup, Turner still sees Univision has the home of soccer.

With a majority of viewers still expecting to watch the World Cup on Univision, according to a study, Univision plans to cash in by carrying pregame and postgame fare and a commercial-free halftime show during the tournament.

Univision also plans to air more than 700 hours of soccer, with another soccer-related announcement due closer to the network’s upfront event in May. Turner expects most soccer advertisers to stay in place. “We have soccer year-round, versus what they’ll have, three weeks of soccer,” he said. “We’re the place to be.”

With interest in news peaking, Univision in September launched a unique noon newscast, Noticiero Univision Edición Digital, that airs on broadcast and is simulcast on digital and social platforms including Facebook Live, YouTube and Periscope.

Speaking of digital, this is the first upfront in which Univision’s new digital assets acquired from Gawker will join broadcast and cable as part of the package being offered to advertisers.

Last year, Univision introduced a programmatic ad facility, and while Turner sees that as something that might grow, right now it’s not a big part of the business.

Perhaps most strategically central, Univision can quantify its viewers’ passion. Turner says 91% of its viewing is live, meaning people see ads when they air. There’s a 95% commercial retention rate and 75% of its audience doesn’t watch any of the other top 10 networks. “That’s a captive audience,” he said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.