Upfront Season Opens in a Bullish Mood

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Related: Lifestyle Shows on a Hot Streak With Sponsors

As upfront season begins, television advertising sales executives are bullish, pointing to a strong economy and a rising stock market.

In the annual commercial-buying bazaar last year, advertisers committed about $18 billion to TV, and paid double-digit price increases to many of the top networks.

But media buyers aren’t expecting this year’s market to be a rerun of last year with respect to pricing. Scatter dollars swamped the market in 2016, allowing some networks to garner double-digit increases in ad rates on a cost-per-thousand viewer basis.

Before negotiations start, the industry will have to work out several key issues, including metrics for measuring viewing that increasingly occurs on mobile and on devices hooked up to over-the-top streaming sources.

Better Yardsticks Needed

Buyers and sellers are looking for better ways to compare the impact and effectiveness of TV commercial impressions and digital ad impressions.

Data is also a big buzzword, and there are questions about how big a role it will play in this year’s market.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

This year’s upfront kicked off on March 2 as Viacom’s Nickelodeon hosted media buyers in New York.

If kids are a leading indicator, Viacom’s head of sales, Sean Moran, predicted a strong advertising market.

“With deregulation coming out of Washington, you’re seeing that increase a lot of corporate spending,” Moran said. “You’re seeing a lot of analyst reports that are showing great earnings. You see the stock market at an all-time high with no signs of slowing down. And you look at the major indicators for different categories, like telco and transportation and auto and others. Those are all moving in the right place.”

Those factors will also help the general ad market.

Bruce Lefkowitz, executive VP of ad sales for Fox Networks Group, said he expects spending to rise in this year’s market as sponsors shift some ad dollars they had been pouring into digital advertising back into TV.

“Last year, there was a stealthy reset of TV’s value, with a few market leaders leading the way,” Lefkowitz said. “I think this year, the reset will be broader and I think you’re going to see more money moving back to television.”

According to Pivotal Research Group senior analyst Brian Wieser, TV ad revenue was up 6.5% last year to $69 billion, including political and Olympics-related activity. He said spending should flatten in 2017, with TV’s share of total ad spending slipping to 32% from 33% in 2016.

It’s early, but Wieser predicted volume in the upfront would be down slightly, with pricing up in the mid-single-digit range. “I’m sure it might change if we look at it again in a few weeks,” he said.

Said Horizon chief investment officer Marianne Gambelli, “It’s a bit early for posturing, but I’m sure all of that will begin to unfold soon enough.

“I think this year’s market will be a lot more moderate than last year,” she said. “The TV market hadn’t seen that kind of strength in a while, which was caused largely by scatter dollars moving up into upfront. Fourth-quarter scatter was soft, however, first quarter is seeing a bit more activity. So it’s still way too early to predict.”

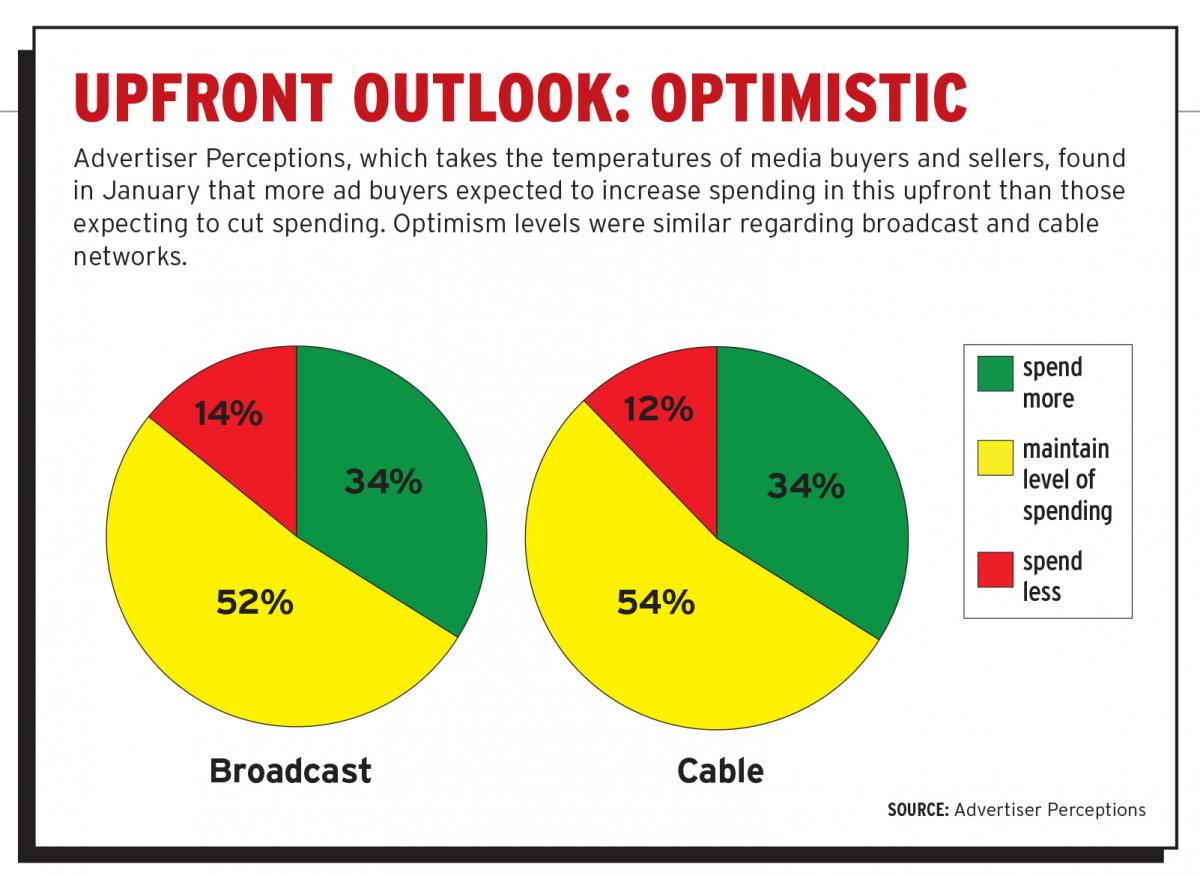

Advertiser Perceptions, a research company that studies attitudes in the ad industry, found in January that more media buyers expected to increase spending on broadcast, cable and digital video than were looking at cuts.

Market optimism spiked during last year’s upfront, according to Andy Sippel, senior VP of media consulting at Advertiser Perceptions. Though optimism has dropped a bit recently, “these scores remain relatively high,” he said.

When it comes to broadcast, 34% of buyers and clients expect to increase spending, compared with 14% who expect to cut back. In cable, 32% expect an increase, with 12% projecting decreases, according to Advertiser Perceptions.

Fox’s Lefkowitz said the role of data would be a wild card in this year’s upfront.

Determining Data’s Place

“Will it be an epic step forward or a baby step forward?” Lefkowitz asked. “There’s a clamor, but people are still figuring out how to effectively utilize it. And that goes from the clients to the agencies to the vendors.”

TV networks have been ramping up their data efforts in order to combat competition from digital advertising, which has promised analytics that show exactly who is seeing ads and how they’re reacting to them. For the past few years, advertisers have discovered that numbers from Facebook and other digital platforms haven’t been accurate and that because of viewability issues and fraud, they’re not getting the bang for their buck they expected.

Last month, NBCUniversal announced that it would set aside $1 billion worth of advertising inventory that will be sold as part of data-driven packages.

Related: No Post-Election Hangover at Fox News

“Ad dollars follow audiences,” Lefkowitz said. “If you look at the rise of cable, it was a cost-efficient alternative to broadcast television. Digital was also a flight to efficiency because there was so much supply out there.

“But it was also a flight to efficiency under the guise of effectiveness. Advertisers thought they could do more with digital ads and get better metrics and data,” he said. “But in my opinion, the effectiveness bloom is off the rose.”

While some advertisers pay for digital ads that are seen for only a second or two, 30-second TV ads appear on a full screen for 30 seconds.

“A two-second impression cannot be as effective in communicating a message as a 30-second television impression,” Lefkowitz said. “There’s also a gradation of the content in the digital landscape. I think that’s what going to shape this year’s marketplace.”

Fox and other networks sell an increasing amount of commercials that run in digital and nonlinear environments. Lefkowitz said 2017 will be a big year for video-on-demand ads.

“It’s clearly a great environment,” he said. “It’s unskippable, it’s full-screen. It’s measurable. They have a reduced commercial load in most pods.

“I think VOD is like cable in the ’90s,” Lefkowitz added. “It’s a great opportunity.”

After airing a Super Bowl that went into overtime and a World Series that went to extra innings in Game 7, drawing the highest ratings in 25 years, Lefkowitz said this will be a big year for sports, which he sees as undervalued.

“There’s one place I know I can generate large-scale reach,” he said. “From September through February, you don’t have to worry about audience erosion. You’ve got the NFL and you’ve got the Olympics. Then you lead into the NBA and baseball.”

Horizon’s Gambelli said measurement would be a big issue.

Nielsen and comScore are working on ways to measure viewing across platforms, but it’s not clear if those metrics will be ready for this upfront. GroupM and the Video Advertising Bureau are pushing for a Unified C7 rating that will include some additional sources in the commercial rating currently used as a currency for buying and selling ads.

“I think we all agree that we want more accurate measurement reflecting shifting viewing to more OTT and beyond the C3 window,” Gambelli said.

Activating viewing that’s happening over-the-top and outside the C3 window is a major challenge and opportunity this year.

“The clients want those impressions and the publishers want to monetize them, but measurement is still far behind, and that’s the challenge,” Gambelli said.

“We are also looking at measurement gaps with out-of-home viewing in areas like sports that have to be worked out,” she added. “In this space, we’ve been getting these impressions all along, but how we value them is the question given that the sound could be low or the viewer could be distracted.

Wanted: An OTT Metric

Sippel of Advertiser Perceptions also said capturing OTT impressions is a theme he’s heard about from advertisers and buyers.

“As we’re heading into the upfront, networks are starting to really get a handle on how to aggregate their audiences across linear OTT as well as full episode players and even including set-top-box video-on-demand,” Sippel said.

“I think the marketers and the agencies are starting to buy into that more and more and are interested in that more and more.”

That’s part of a big effort to achieve reach, Sippel said.

“As reach gets disaggregated, people are going to aggregate it back up into a big thing,” he said.

Both buyer and seller are also looking to create bigger deals and bigger partnerships.

“As people are trying to get large reach with the highest-quality video, I think that’s going to play into the hands of the big, legacy players who have their arms around how to actually sell those programs across all the platforms they have,” Sippel said. Ad packages include commercials plus integrations, digital extensions and social elements.

“I’m seeing a lot of focus from our media customers in how they focus on their larger customers,” he said. “The focus is less about negotiating CPMs and more about having pre-upfront conversations with their biggest customers. All these TV customers have settled in on the need to drive money from their top 20 or 30 accounts.”

Upfront’s New Role

Sippel said that while the upfront presentations themselves remain important, they largely fill a different role in the process.

“Before it was truly about announcing all their great new shows and kicking off the deal-making,” he said. “It’s still important to put on a great show and have people understand what you’re all about. It’s still an incredibly important branding statement.”

But advertisers are making larger investment with programmers.

“You want to feel really good about your investment and the upfront presentation is one way for your strategic vision to come to live and make your customers feel really good about the investments they’re making with you,” Sippel said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.