U.S. TV Ad Revenue To Fall 0.6% In 2024, GroupM Forecasts

With less than half of households subscribing to pay TV, linear TV expected to decline 8.9%

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Total television advertising revenue–excluding political spending–is expected to decline 0.6% to $64.1 billion in 2024, according to a new forecast from giant media agency GroupM.

In addition to traditional linear TV, the total includes connected TV, which GroupM says will account for 30.2% of TV revenue, or $19.4 billion this year.

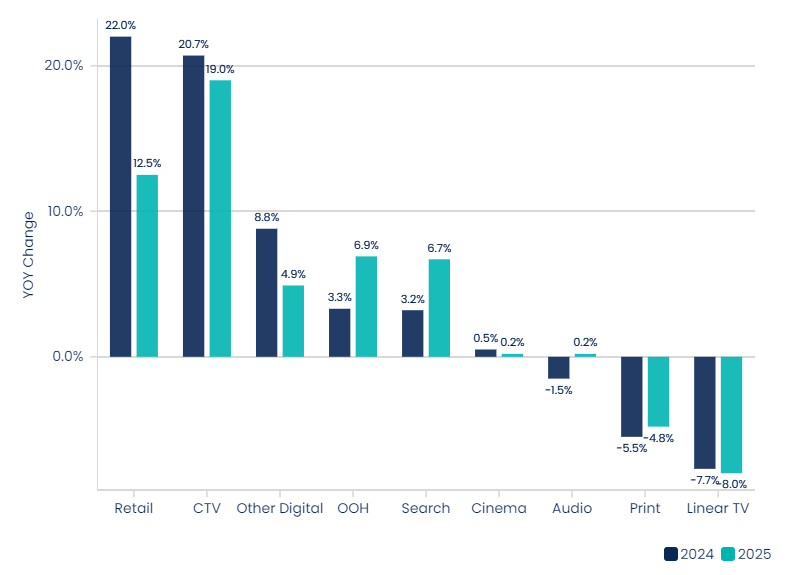

Revenues from CTV are expected to jump 20.7% in 2024 and 19% in 2005.

By 2029, CTV will generate 51.1% of all TV revenue, GroupM says. (GroupM includes some YouTube spending in its TV totals.)

By the end of the year, GroupM expects that less than half of all U.S. households to be pay-TV subscribers. Linear TV revenue is expecting to fall 8.9% in 2024 and another 6.9% in 2025.

Political advertising is expected to surpass $15 billion during the 2024 Presidential election cycle. Looking ahead, GroupM sees political advertising climbing above $17 billion if there’s a presidential election in 2028.

Retail media will be the fastest growing segment again in 2024, GroupM said. Retail media will grow 22% to reach $47.9 billion in revenue. At that rate, it will surpass traditional TV ad revenue a year sooner than expected.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The largest retail media owners in the U.S. are Amazon, Walmart, Instacart, eBay, and Target, GroupM estimates.

Overall, GroupM forecasts that U.S. advertising revenue will grow 5.8% in 2024 and 4.9% in 2005.

“While there are potential cracks under the surface, such as the increase in buy-now-pay-later debt, rising delinquency on auto loans and credit cards, and slowing sales at some national retail outlets, the overall resiliency of consumer spending, especially among more affluent consumers, has driven continued economic growth,” according to the report.

Global advertising revenues are expected to grow 7.8% in 2024 to $99.8 billion. GroupM’s previous forecast in December called for an increase of only 5.3%.

The more optimistic forecast stems from digital growth, recovery in markets including China and accelerating adoption of retail media, CTV and AI, according to Kate Scott Dawkins, who wrote the report for GroupM.

In 2025, GroupM expects global advertising revenues to increase 6.8% to reach $1.1 trillion, a level the agency hadn’t expected to achieve for another year.

Total TV–linear and CTV– is expected to grow 2.7% to $163.2 billion in 2004, after a 0.4% drop in 2023. But over the next five years, traditional TV is expected to decline 0.2% over the next five years on a compound annual basis (excluding the hyper-inflationary markets of Argentina and Turkey).

Digital pure-play advertising will make up 70.6% of total industry revenue in 2024. By 2029, digital will grab 74.9% of ad revenue, or $985.6 billion.

Global CTV ad revenue is expected to grow 20.1% to $38.3 billion in 2024. Another increase of 20.1% is expected for CTV in 2025.

Retail media will account for 15.1% of total ad revenue in 2024. A decade again, it represented just a 1.5% share.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.