ViacomCBS Set to Beef Up All Access Streaming Service

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

ViacomCBS is expected to announce a more aggressive streaming strategy by the time it announced its earnings on Feb. 20, sources said.

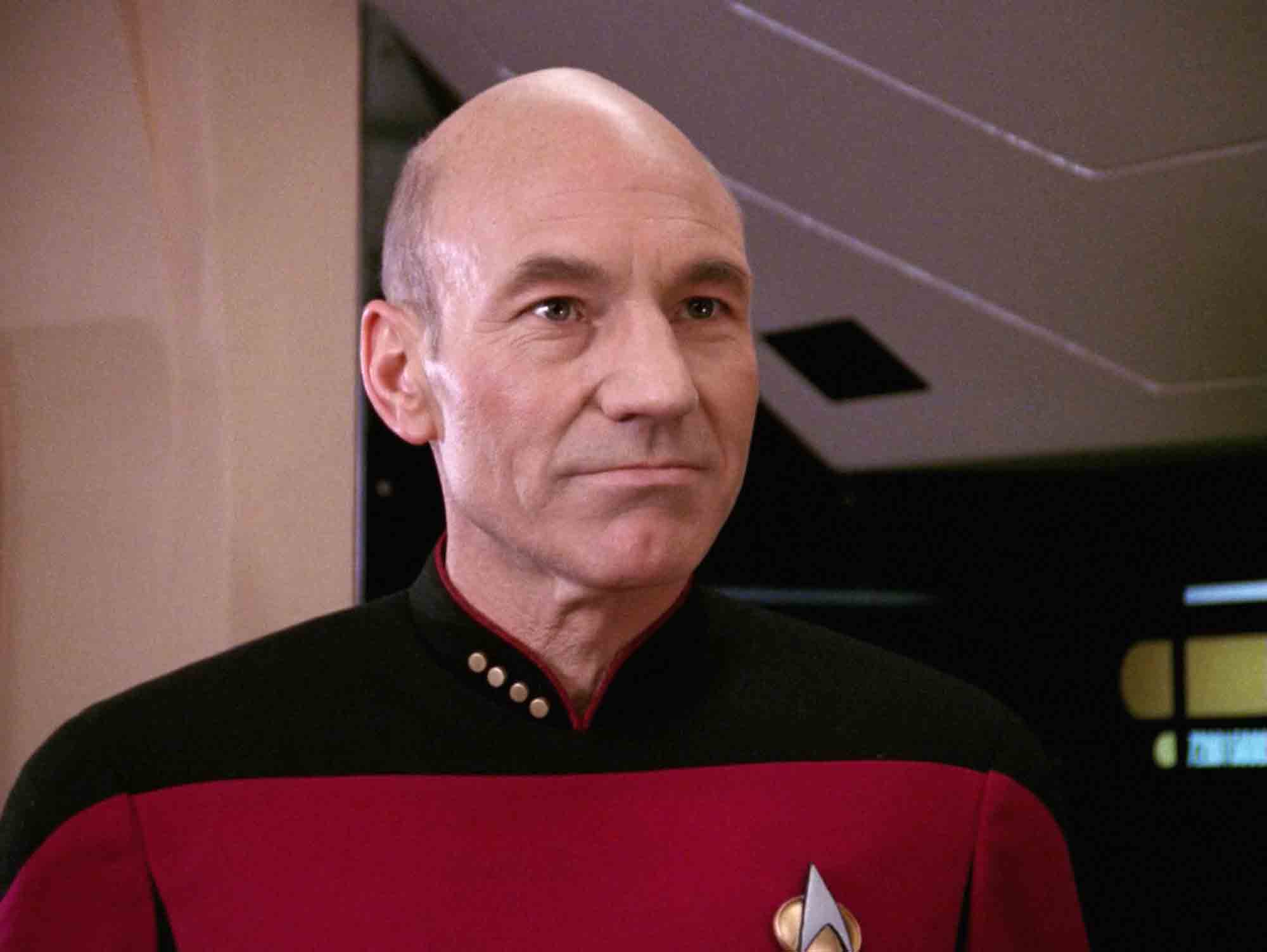

The newly combined company is expected to expand its CBS All Access streaming service, which was the first streaming service introduced by a broadcast network. Since then, other media companies have jumped in with larger direct-to-consumer offering to compete with Netflix, which was siphoning off viewers.

Part of the rationale for combining Viacom and CBS, which were both controlled by the family of Sumner Redstone and his daughter Shari Redstone, was to create scale in order to compete in a TV business that was moving toward streaming and a direct-to-consumer subscription model.

While expanding All Access, ViacomCBS is expected to keep its advertising supported Pluto TV as a free service.

CNBC was the first to report that ViacomCBS planned to expand its streaming business.

All Access is expected to add content from the legacy Viacom channels and put programming from Showtime on a premium tier.

Movies from the ViacomCBS’s Paramount library will also be part of the offering, but it won’t necessarily be where all Paramount movies land immediately after theatrical release.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

It is unclear how much ViacomCBS plans to charge for the new service or its premium tier.

Under CEO Bob Bakish, the company has been trying to improve its relationships with cable and satellite distributors. It last year made a deal to get CBS All-Access integrated into Comcast’s X1 operating system. The company is expected to work closely with its distribution outlets as it rolls out the expanded streaming product.

The company currently operates an over-the-top showtime service. Combined CBS All Access and Showtime over-the-top have more than 10 million subscribers.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.