Weaker Upfront May PutPressure on Scatter Market

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The brodcast upfront market was weaker than expected, which means the networks will have to sell more of their commercial inventory in the scatter market.

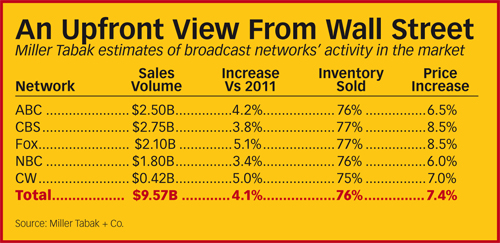

Broadcasters typically aim to sell about 80% of their inventory in the upfront, but analyst David Joyce of Miller Tabak + Co. estimates they sold only about 77% in this upfront so they could maintain price increases, which were in the 6% to 9% range. Economic factors including the stock market, unemployment and global financial issues impacted the scatter market and “had the effect of dampening the upfront negotiations,” Joyce said in a report.

Information about the upfront is carefully guarded by the networks, which opted not to comment on their negotiations. Most media buyers said volume for the broadcast upfront was down compared to last year’s booming upfront. But according to sources familiar with the negotiations, CBS and NBC, the networks at the top and the bottom of the food chain respectively, both registered small increases in volume, while Fox, ABC and The CW were flat.

Also, General Motors, looking to reduce its media costs, shifted some spending from broadcast to cable, where prices for original programming are lower. It was not clear if GM had done deals with all the major broadcasters by the end of last week.

In his report, Joyce estimated the broadcast upfront totaled $9.6 billion, up 4.1% from 2011. But Joyce’s figures appear to be overly bullish, according to sources on both the buy and sell sides of the negotiating table.

David Bank, analyst at RBC Capital Markets, said that amid the murkiness surrounding upfront volume and pricing, it’s more important to look at inventory levels. “That is more interesting to me than volume, because of the environment it sets up for the scatter market,” Bank said.

“You could argue that the CBS pricing was a touch lower [than expected], but as far as Wall Street is concerned, we’re pretty indifferent between a 10 and a 9,” Bank said. “What you’re less indifferent about is, did we preserve some sort of scarcity in inventories, and it feels like inventories [sold in the upfront] were a little light. They probably held back more than they would have liked to. And that puts a little bit of a headwind on the scatter environment next year.”

Joyce estimated upfront sales as a percentage of the broadcast nets’ total sales would be 61.8%, down from 62.5% in the 2011-12 season.

Some network execs believe it’s important to maintain pricing levels, even if that means turning away sales, because once cut, it can take years to push rates back up to their former levels. That can result in lower revenue in a weak market.

“The [network that] benefi ts most if they did hold back inventory to maintain price integrity is [the one that] has the least amount of risk in their schedule, and that’s CBS,” Bank said. “If [the other networks] have a ton of make-goods, the only guy who’s going to have dry powder is going to be CBS. And they’re the guys that it matters most to.”

To Wall Street, the upfronts, and ad sales in general, are becoming a less significant part of how the companies that own the broadcasters are valued. “All the other factors—the affiliate fee growth, the digital-distribution sales to Netflix, Amazon, Hulu, retransmission— those are far bigger drivers, and they’re the reason we’re so bullish on the sector,” Bank said. “All I need is a stable ad environment.”

With broadcast wrapped, buyers have turned their full attention to cable and syndication.

Negotiations were moving at a more deliberate pace than last year’s, but cable sales execs said that while budgets weren’t as strong as expected, they were looking at a market that would be up between 5% and 7% overall.

“It’s hard work,” said Mel Berning, president for ad sales at A+E Networks. “Last year was a one in 10, one in 12 kind of year. The fact that we’re up versus last year is remarkable. It’s actually a fairly solid marketplace when you’re talking [price] increases that are mid-to-upper singles. That’s not too shabby.”

Volume appeared to be up, with dollars “up 5%,” Berning said. “If you’ve got ratings points, you’ll see more than that, as long as you’re reasonable. I think money moved away from broadcast and stopped first at top-tier cable networks.”

Many of the major cable network groups were more than halfway sold at the end of last week.

Syndication was also moving toward completion. “It appears that it’s a fair, flat market for syndication,” said Michael Parent, senior VP and director of broadcast at media agency TargetCast tcm. “There are a lot of untested shows in daytime,” Parent said, noting new fall talk shows hosted by Katie Couric, Jeff Probst, Ricki Lake and Steve Harvey. “The Oprah void has never been filled, and the viewership has trickled all over the place. The agencies are getting the prices they’re looking for.”

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.