YouTube TV: Everything You Need to Know About What Is Now the 4th Largest Pay TV Platform in America

How Google's $35-a-month skinny bundle turned into the only thing in linear TV that's still growing

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

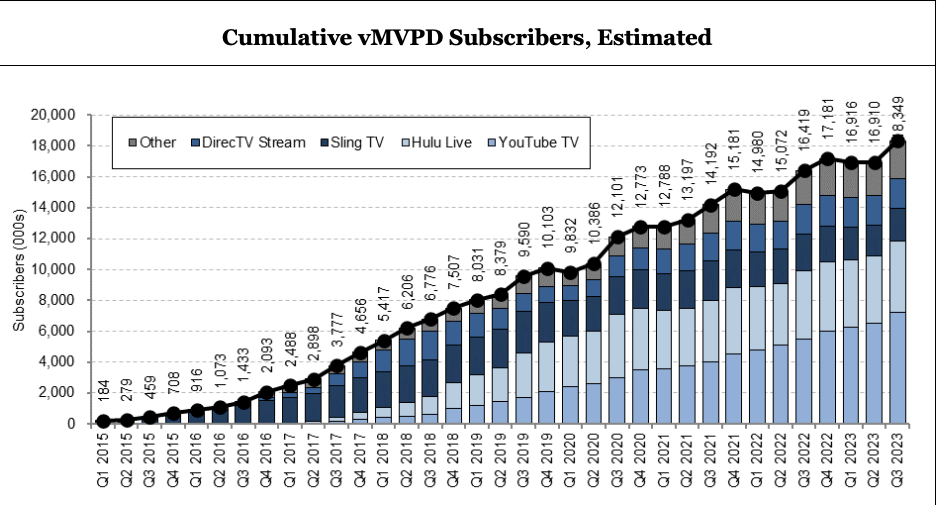

YouTube CEO Neal Mohan recently revealed that the company’s YouTube TV vMVPD service has surpassed 8 million subscribers, supplanting Dish as the fourth largest pay-TV platform in the U.S., behind Charter, Comcast and DirecTV.

YouTube TV long ago cemented its place as the largest virtual MVPD (vMVPD), well ahead of second place Hulu Plus Live TV, which touted around 4.6 million subscribers as of the end of 2023.

A Feb. 6 letter to investors from equity research company MoffettNathanson admits that, after touting YouTube TV’s success over the past couple of years “in coming to dominate the vMVPD business… Now it’s clear that the growth at YouTube TV is even stronger than we had anticipated.”

It All Started as Just a Super-Cheap Skinny Bundle

Launched in 2017, at a time when “skinny bundles” were the big craze as viewers sought to shed some of the pay-TV bundle bloat in favor of smaller cheaper packages, YouTube TV was priced to fill that demand. For $35 a month, users got a package of about 60 channels, including the major broadcast networks, as well a respectable serving of over 40 cable channels.

But alas, creeping bloat inevitably set in. And in 2019, the company hiked the price to $50 per month after adding Discovery’s lineup of networks to the platform.

Then in June 2022, the company upped its monthly fee again, from $50 to $64.99 after adding ViacomCBS channels.

YouTube TV’s last big price increase in March 2023 brought upped the monthly bill to $72.99.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

YouTube TV offers a base tier of more than 110 channels, along with numerous optional add-on packages, including 4K Plus, Spanish Plus and Sports Plus as well as third-party add-ons like Max, Starz, CuriosityStream or AMC Plus.

Subscribers have the flexibility to cancel at any time and they can watch on just about any device with a web browser or any of the popular platforms, including Google Chromecast, Apple TV, Fire TV and Roku players and TVs.

Fast Growth

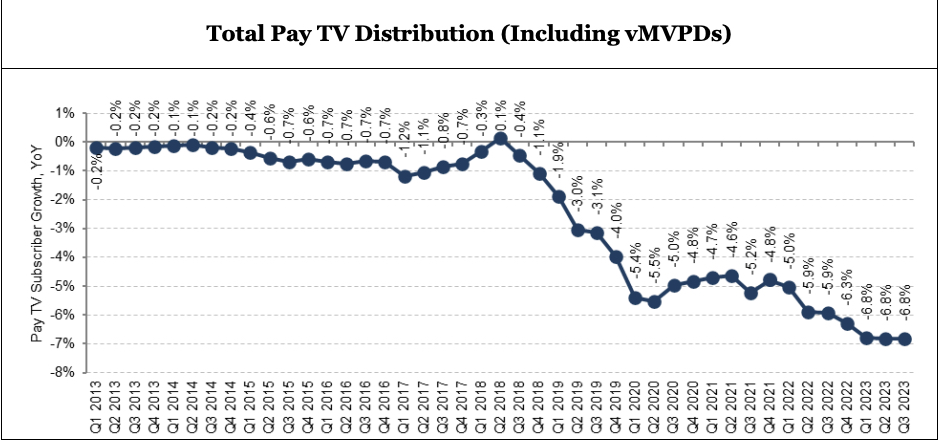

YouTube TV's rise through the vMVPD ranks has been somewhat dramatic as traditional pay-TV operators have been shedding subscribers at an accelerating rate.

Parent company Alphabet doesn't typically break out subscriber metrics for the Google operating unit pay TV service.

Before releasing the 8 million figure in February 2024, Alphabet said in July 2022 that YouTube TV had amassed 5 million subscribers after about five years in operation.

So, within a span of about 19 months -- as Comcast, Charter and DirecTV collectively bled millions of subscribers -- YouTube TV added around 3 million paying customers.

In its February 2024 report, MoffettNathanson noted that the growth of YouTube TV is perhaps the only thing keeping cord cutting from accelerating further.

Longtime Pay TV Incumbents Are Just Handing Over the Keys

Remarkably, the pay tv business has gotten so untenable for small-to-midsized cable operators that they’ve been willing to just point their customers to a vMVPDs like YouTube TV under a marketing partnership agreement, wash their hands of it and stick to selling broadband.

In fact, this has become a business driver for YouTube TV. Smaller cable operators, who lack the bargaining clout of Comcast or Charter, can get eaten alive in the crazy world of pay TV carriage rights and many of them are happy to hand over their customers, wholesale, and maybe just work out a joint-billing arrangement or bundle it with broadband for a year to keep their customers happy.

In March, Frontier Communications, which has bundled third-party virtual pay-TV services with its fiber-based high-speed internet service tiers for several years, started integrating its customers’ monthly fees for YouTube TV with their main broadband bill.

Customers are showing a definite preference for this type of bundling of their communications services, especially when it comes with a bit of a discount.

Last summer, Englewood, Colorado-based midsized cable operator WideOpenWest (aka “WOW!”) officially shuttered its own IPTV service, WOW! TV Plus, and made YouTube TV its go-to video platform, transitioning its remaining 117,000 customers to YouTube TV.

In August, WOW! began offering YouTube TV to new customers at a $10-a-month discount for one year, with the virtual pay TV's billing integrated into their monthly high-speed internet and/or mobile statement.

In November, the company reported that more than 13% of its new customers are signing up for the YouTube TV bundle.

WOW! CEO Theresa Elder told analysts during her company's third-quarter earnings call that the relationship was mutually beneficial. "One of the things we're also seeing is we have new customers who perhaps wouldn't have considered us before, [they] are considering us now because of the YouTube TV offering,” she said.

Even Charter, now the biggest pay-tv operator in the U.S., seemed quite willing to walk away from the whole pay-TV business during a recent two-week standoff with Disney that saw a blackout of ESPN’s fall football coverage. Throughout that time, Charter directed football hungry fans to sign up for YouTube Live TV or Fubo.

It was enough to make Disney blink in a carriage negotiation.

In the end, Disney relaxed its notoriously stringent bundling demands, letting Charter jettison a few less popular channels, including Baby TV, Disney Junior, Disney XD, Freeform, FXM, FXX, Nat Geo Wild and Nat Geo Mundo.

But more importantly, Disney conceded wholesale discounts for Charter to resell Disney Plus and ESPN Plus bundled with its own Spectrum TV Select programming package.

Those concessions were enough to keep Charter from throwing its hands in the air and walking away from the video business altogether, at least for now.

Integrating NFL Sunday Ticket

In late 2022, YouTube TV won a bidding war, beating out other deep-pocketed competitors like Apple, Amazon and Disney, for the highly prized NFL Sunday Ticket package of out-of-market games football games.

Since 1994, NFL Sunday Ticket had been a crown jewel for satellite operator DirecTV, which had been paying about $1 billion per year in recent years, but the satellite operator was forced to walk away from the table when the stakes got too high.

YouTube TV is reportedly paying the NFL as much as $2.5 billion annually for Sunday Ticket, which offers Sunday-afternoon NFL telecasts in markets where the games aren’t available locally.

With Sunday Ticket in its back pocket, YouTube TV signed on as a presenting sponsor of the NBA Finals in June and blitzed ABC’s live broadcast with so much promotional content, that even seasoned sports pundits thought its omnipresent ads were overbearing, calling them “breathtaking even by modern sports standards."

As the NFL season kicked off, YouTube TV parent Google flexed some of its “vertical integration” muscle when it integrated NFL Sunday Ticket natively on the Google TV, promoting the package to millions of Americans on their TV’s home screen. In the U.S., Google TV powers not only the popular Chromecast With Google TV CTV device, but also smart TVs made by Hisense, Sony and TCL, among other brands.

The service kicked off in September with the start of the NFL season. Aside from some pre-season promo offers, the service was priced at $299 for existing YouTube TV subscribers, or $349 for non-subscribers.

As the season progressed, the company lowered the price. By Thanksgiving it was down to $174 and in December, as the season entered its 15th week, the price dropped to as low as $79 for the remainder of the season.

The company hasn’t revealed how many subscribers have taken the package, but in October, Morgan Stanley Research estimated that YouTube TV had around 1.5 million NFL Sunday Ticket subscribers and that it would take around 3.18 million subscribers for Google/YouTube to break even. As a result, NFL Sunday Ticket probably generated a loss of around $1.2 billion in its first season, according to Morgan Stanley.

This has sparked discussion about how NFL Sunday Ticket may just be a loss leader for Google or YouTube TV, but what business doesn’t lose money in its first year?

For a company like Google, $1.2 billion a year is just petty cash. To put things in perspective, in its most recent quarterly report, YouTube reported a 15.5% year-over-year increase in Q4 ad revenue, which reached $9.2 billion, but that includes its wildly popular streaming website alongside the vMVPD service. The company does little to break down the numbers for its media business beyond that, but overall, the internet company reported Q4 revenue of $86.31 billion.

In that context, a $1.2 billion bet on NFL football’s popularity in the U.S. seems like a bit of a no-brainer.

Pay TV Blackouts and Other Kerfuffles

YouTube TV has had its share of business disputes along the way. In 2021, the company had a small carriage dispute with Disney that resulted in a 36-hour blackout that kept ABC, ESPN, FX, Disney Channel and other Disney-owned networks off YouTube TV. At the time, the company offered a $15 credit for customers who were impacted by the blackout.

Perhaps the company’s largest dispute was a ruckus brawl with Roku in 2021 that spilled over quite publicly when Roku dropped the YouTube TV app from its app store. Roku said Google was demanding that it manipulate search results to favor YouTube TV. The dispute wasn’t resolved until eight months later, when Google reached an agreement with Roku.

In 2022, a group of YouTube TV subscribers across four states filed an antitrust lawsuit against Disney, accusing the company of using its market power to unfairly jack up prices on their virtual pay TV service. The antitrust filed in a San Francisco alleges that Disney uses the most-coveted asset in the pay tv ecosystem, ESPN, as well as its leverage over Hulu, to dictate pricing in the virtual pay-TV market. (A judge recently allowed the case to proceed).

In February of 2023, MLB Network went dark on YouTube TV amid a high-profile carriage dispute, just as the league was getting ready for spring training.

YouTube TV also got a slap on the wrist last summer from the National Advertising Division saying that the company’s marketing department went to far when it claimed that YouTube TV is "$600 cheaper than cable" and that YouTube TV should abandon those long-standing apples-to-oranges claims.

New Features

In December, YouTube TV started testing a new feature that lets users easily toggle back and forth between two channels with the push of the "OK" or "select" button on their remote. YouTube TV's app-based experience, which doesn't assign numbers to channels, is perhaps the most un-linear-like among all vMVPDs.

But since many of its customers are linear pay TV refugees, sent to YouTube TV after their small or midsized cable company abandoned traditional video, adopting a few of the old-school popular features might not be a bad idea.

Other recent updates include experimental “Decreased Delay” and “Build Your Own Multiview” features.

The Decreased Delay feature allows users to reduce the kind of broadcast delay latency issues that plague live sports. Of course, the trade off is that less buffering means more room for errors and glitches that can impact service quality. Users run the risk of more frequent interruptions in order to avoid sports spoilers.

YouTube TV’s Build Your Own Multiview feature lets viewer select up to four live sports streams for their own Multiview screen. (Previously, Multiview users were limited to preset selection of games).

The Big Picture

YouTube TV is one of a handful of vMVPDs positioned to actually fill the void as legacy pay-TV operators retreat.

In fact, analysts at MoffettNathanson have recently wondered if YouTube TV’s rapid growth could be enough to flatten the fast-accelerating rate of cord-cutting.

On the other hand, there are a whole new generation of FAST services that are creeping up from behind and it’s unclear what constraints, limitations and growth pains they may face in future.

Watch this space. We’ll be updating with major developments.

Freelancer Scott Lehane has been covering the film and TV industry for almost 30 years from his base in southern Ontario, near Toronto. Along with several Future plc-owned publications, he has written extensively for Below the Line, CinemaEditor, Animation World, Film & Video and DTV Business in the U.S., as well as The IBC Daily, Showreel and British Cinematographer in the U.K. and Encore and Broadcast Engineering News in Australia, to name few. He currently edits Future’s Next TV, B+C and Multichannel News daily SmartBriefs. He spends his free time in the metaverse, waiting for everyone else to show up.