I Got My Peacock TV

When the sidecar device becomes a gatekeeper, consumers’ feathers get ruffled

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

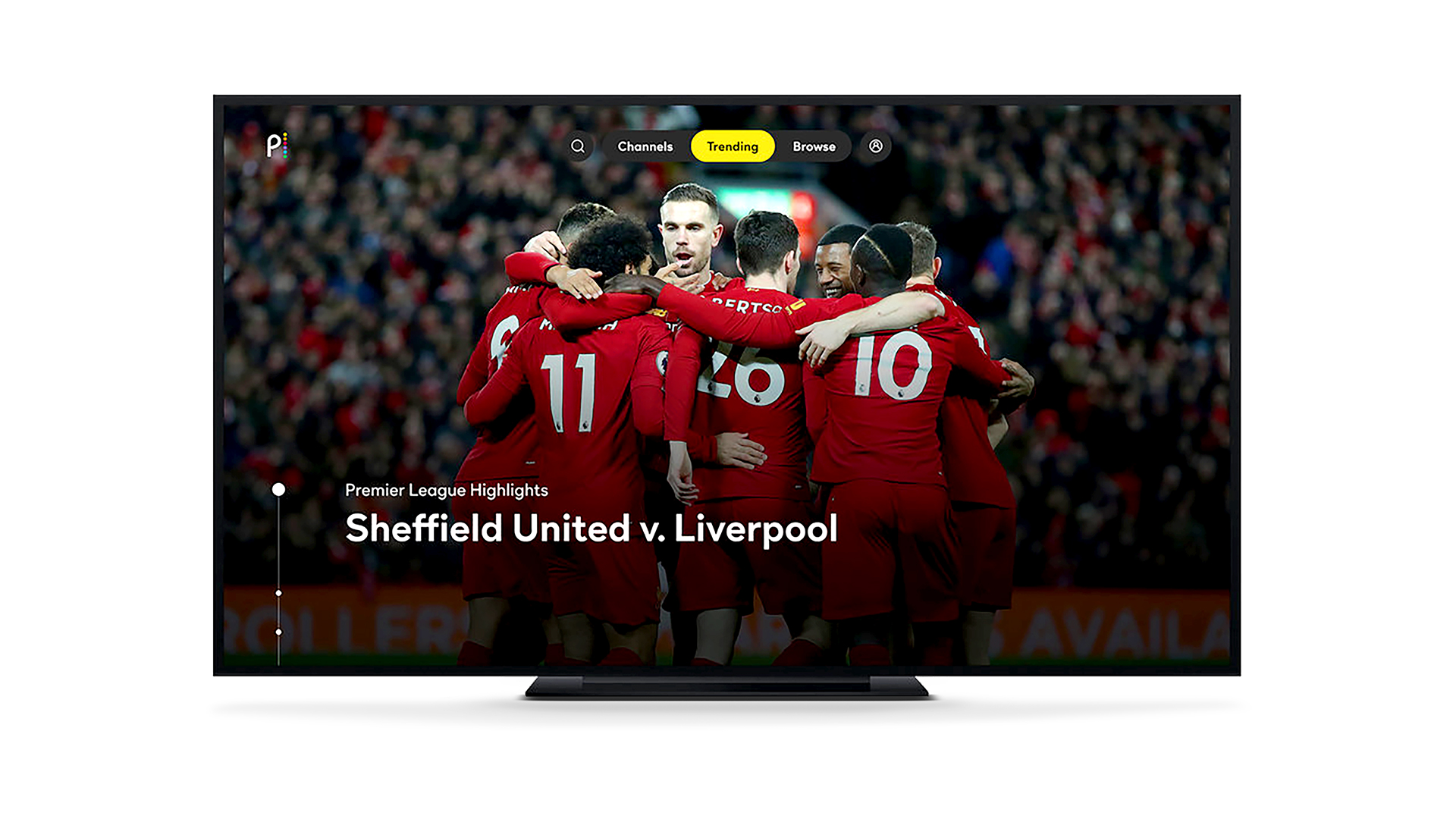

Peacock TV has landed in my living room, after some anxious days of wondering if I would be compelled to use a laptop or mobile phone to watch the English Premier League soccer I am paying extra to receive.

It is the latest lesson in leverage. I had none: I complained on Twitter but no one listened. Roku had some. The Comcast NBCUniversal conglomerate had the most.

You probably saw how quickly it came about after weeks of seemingly no progress. Peacock launched nationwide on July 15 as a direct-to-consumer service, with a free ad-supported version and premium (pay) renditions.

It’s delivered on the internet: No video package needed from cable or satellite. Remarkably, though, the little black box near my TV, a Roku 4 device, didn’t have Peacock as a channel. (A few clever free channels sprang up, though, like a Peacock screensaver, to entice customers searching for it.)

Comcast NBCU is seriously committed to Peacock as a vehicle to reach consumers with ads and new monthly subscriptions. NBCU’s EPL matches, shown here on weekend mornings and some weekday afternoons, have bounced around from channel to channel, linear and streamed, but have lately been funneled to the Peacock pay version. That’s a traditional form of leverage: buying sports rights and charging cable companies more to show the games, or charging consumers directly to view them.

Problem for NBCU is that Roku is more than just a sidecar device to deliver internet channels to the TV. It’s the most popular such device in the country, and has its own criteria for enabling that access. Whatever those terms are — they have been reported to be a share of the revenue charged for the channels — they were unacceptable to NBCU. (NBCU still has a standoff with Amazon over Fire TV access.)

Stuck in the Middle

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

On Sept. 18, with the second day of EPL matches ahead, NBCU pulled another traditional lever programmers use in spats with distributors. It informed Roku that it would soon lose access to the NBC app and “TV Everywhere” extensions of NBCU cable channels like USA, Syfy and CNBC. Those are extensions only available to viewers who have those channels on cable, anyway, so that’s not as potent a threat as, say, pulling CBS or Fox signals ahead of the Super Bowl.

But the ice seemingly broke. By the next day, Roku and NBCU came to terms over the NBC apps, including, crucially, Peacock. A couple of days after that, Peacock strutted onto Roku’s channel lineups.

By now, consumers are used to these kinds of blackouts caused by dollar disputes. Some of them are only for a day or two. Some last for years.

By now, consumers are used to these kinds of blackouts caused by dollar disputes. Some of them are only for a day or two. Some last for years. Los Angeles Dodgers baseball local-TV rights were acquired by Time Warner Cable and the games were put onto a new regional sports network in 2014 that most distributors in the L.A. market (other than TWC, now part of Spectrum) refused to pay for. That persisted until April of this year, when DirecTV parent AT&T signed a carriage contract that also includes the online pay TV service AT&T Now.

Cable companies — which only started paying cash to carry broadcast networks in the early 2000s, believe it or not — feel oppressed by the leverage that broadcasters have to charge them more and more. Broadcasters respond that their programming is valuable and, besides, in many cases, cable is the only real provider

of high-speed internet service that reaps huge profits for cable, so operators can afford to pay.

The best way around these impasses that squeeze the consumers caught in the middle is to have alternatives. If your cable company has lost a local broadcaster, get a digital antenna or switch to an online “virtual MVPD” that still has it. If you’re unhappy with your cable internet, if you can, switch to a competitor. At some point, 5G should provide wireless competition.

It’s a bit galling, maybe even ironic, to see these gatekeeper situations extend to direct-to-consumer services, and to see Roku or Amazon or Apple TV stand in the way of me and English Premier League soccer. I was pleased to see cooler heads prevail in this particular dispute.

Now, about HBO Max …

Kent has been a journalist, writer and editor at Multichannel News since 1994 and with Broadcasting+Cable since 2010. He is a good point of contact for anything editorial at the publications and for Nexttv.com. Before joining Multichannel News he had been a newspaper reporter with publications including The Washington Times, The Poughkeepsie (N.Y.) Journal and North County News.